10 Jul Enterprise software investments may be tepid now, but they’re poised to engage

Have we reached “peak software”?

Just like the idea of “peak oil” — the hypothetical point at which global oil production could max out — you could say we’re approaching a saturation point for venture-capital investments in software companies.

Recent data from PitchBook shows that venture investing in software companies has plateaued: The amount of VC money invested in these companies — $32 billion last year — remained roughly constant over the last four years. The actual number of venture-backed software investments, mostly for business-focused companies, has actually declined, from 4,068 in 2014 to 2,980 last year.

But software is not, in fact, a declining industry. As I explore with my colleague Neeraj Agrawal in a recent report called Software 2018, released last month, a closer look at the PitchBook data shows that the fall-off in software deal volumes is primarily in the Bay Area, where an overheated market has boosted valuations and caused some investors to temporarily pull back. Investment in other U.S. regions, and globally, is actually going up. Investment in software companies based in Europe, Canada and Australia/New Zealand, for example, was $5.4 billion in 2017, up nearly 69 percent from the previous year.

Perhaps more important, a number of broader, global mega trends continue to fuel software innovation today, promising more new companies and more new jobs. These trends include everything from the rise of artificial intelligence, which is pushing software into new fields like autonomous driving, to the recent corporate tax cuts in the U.S., which could free up hundreds of billions of dollars for big corporations to buy up software startups.

Mary Meeker just released her annual, consumer-focused Internet Trends report in May. But here are some of the key trends we see shaping the global, mostly business-focused software market this year:

(Photo by Tomohiro Ohsumi/Getty Images)

SoftBank: Not just for consumer companies anymore

SoftBank’s new, $100 billion Vision Fund has had a huge impact on the technology industry already, given the Japanese firm’s ability to essentially play kingmaker in a given technology market by making a huge investment of hundreds of millions of dollars in one company. This, obviously, makes it extremely difficult for competitors to keep up in terms of building market share. And if a company declines SoftBank’s money, there’s the potentially lethal possibility that SoftBank could fund a competitor, essentially snuffing out the first company.

What’s less noticed, however, is that SoftBank is investing in many business-focused software companies, not just big consumer names like Uber, FlipKart and SoFi. Softbank recently put $2.25 billion into GM’s Cruise business unit for autonomous driving and $250 million into secondary storage vendor Cohesity, for example, and has backed other B2B players such as construction/building-software outfit Katerra; real-estate software company Compass; and workplace chat app Slack.

With these investments and others, SoftBank is accelerating the pace of growth in many key software markets and likely also dampening these companies’ IPO prospects, since companies receiving several hundred million dollars from the Japanese company face less of a financial need to go public. SoftBank is essentially taking the place of an IPO.

Image: Bryce Durbin/TechCrunch

More software means less hardware, more robots

The continuing march of software innovation isn’t great for everyone — losers in this picture could include hardware vendors and people with jobs that can be automated by smart, software-powered robots. (Yes, even lawyers and doctors could be affected — it’s not just truck drivers.)

The implications of artificial intelligence on the job market, and the auto industry, have been widely discussed. Less noticed, though, are the shifting growth rates in cloud-based IT gear versus traditional IT hardware, the technology that powers large corporations and other organizations. IDC predicts that by 2020, corporate spending on cloud-infrastructure software will finally exceed spending on non-cloud IT infrastructure — meaning all those boxes inside corporate data centers from vendors like Dell, IBM, Cisco, H-P etc. Many of those companies are trying to figure out their cloud services approach to stay relevant.

Lower taxes = more software M&A

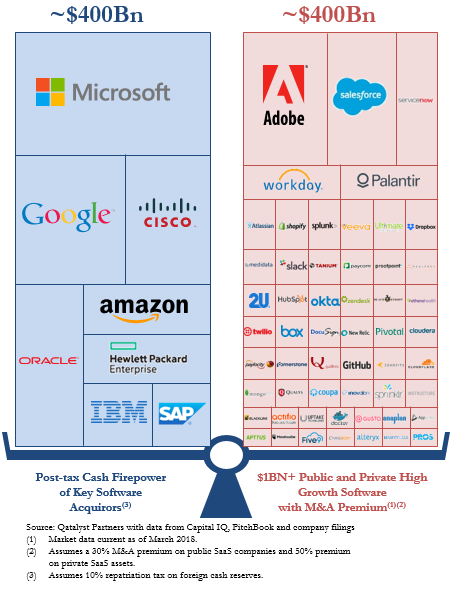

Not everyone loves the Trump administration’s policies, but if you’re a software CEO, you might be a fan of the administration’s new tax bill. That’s because the 2017 bill could be a boon for software-industry M&A. Two key components of the new law — the reduced rate charged to companies to repatriate cash from overseas and the lowering of the corporate tax rate to 21 percent from 35 percent — could leave many big tech acquirers with new war chests, analysts believe.

According to investment bank Qatalyst Partners, both changes could leave a group of the largest traditional tech-company acquirers with an additional $400 billion to spend, if they repatriate money from overseas. This would be enough to buy 50 leading software companies today, according to Qatalyst. We have already seen some of this with the recent acquisitions of GitHub by Microsoft ($7.5 billion) and Adaptive Insight by Workday ($1.55 billion) and Q1 deals like MuleSoft by Salesforce ($6.5 billion) and CallidusCloud by SAP ($2.4 billion).

The traditional tech acquirers could be more receptive to acquisitions than ever these days, given that the easy, low-cost cloud business model has allowed a range of young tech upstarts to attack many parts of their businesses from all angles. Often, the easiest solution is for the big tech companies to buy the upstarts.

Niche is nice for software

As software transforms big, well-known corporate markets — like data center software, and technology for functions like human resources, sales and marketing — it is also making inroads into much more narrow industries and corporate functions. The low cost of the cloud makes it easy for every industry, from physical therapy to prison management to mortgage lending, to grow its own, customized software, usually deployed for tasks like operations and customer management. Often there are multiple firms vying for customers (and investor dollars) today in these specialized fields.

Similarly, software is fueling extremely specialized companies to serve business needs inside companies today. These include companies as varied as DocuSign, which has built a multi-billion dollar public company focusing exclusively on document signing, and Carta, which sells technology to help companies manage their financial cap tables.

Mary Meeker is right that consumer internet trends like the rise of online wallets, subscription services for certain goods and increasing oversight of social media by regulators will have big economic implications in the years to come. But we humbly offer that business software is a pretty big economic driver too — you just have to work a little harder to figure out the implications for businesses and the markets.

Sorry, the comment form is closed at this time.