22 Jun How to Make the Most of Paid Media Right Now via @brentcsutoras

During an economic downturn, ad market dynamics and ad buyer behaviors shift.

Amid these changes, it’s critical for consumer brands to continue to advertise.

Marketers and the agencies that work with them can continue to drive growth through smart segmentation, even while the economy softens.

The key is to focus on where you get the best results, using channels that enable flexibility and targeting audiences that show intent.

On June 17, I moderated a sponsored Search Engine Journal webinar presented by Dan Dillon, VP of Marketing at Reveal Mobile.

Dillon provided practical and actionable guidance for advertising to audiences who are most likely to convert.

Here’s a recap of the webinar presentation.

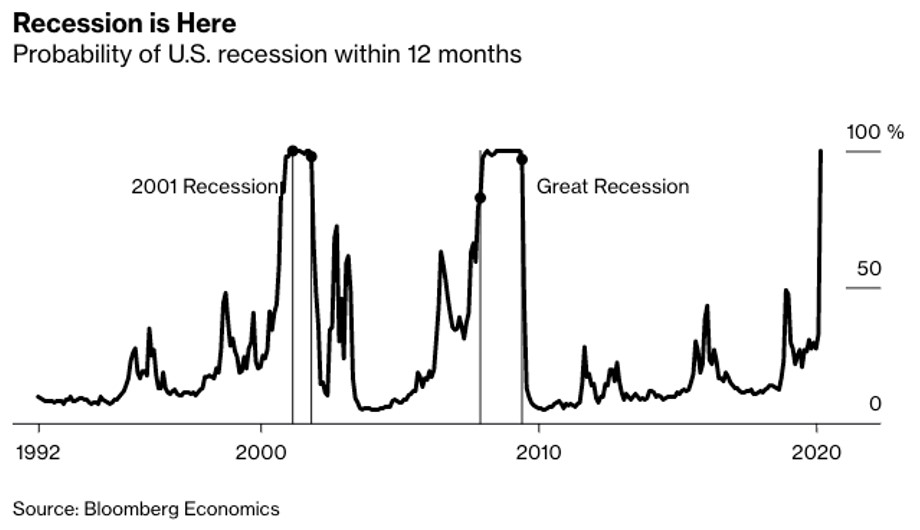

The recession is here. It’s now officially in the headlines.

While the headlines are also dominated by the job market and reopening during the pandemic and racial injustice, the U.S. economy officially entered a recession in February.

In another month, once we see summer spending continue to drag, the recession will continue to crop up as a headline.

Learn how you can prepare for what’s already here and help your brand or your clients’ business weather this brutal storm with as much know-how and resilience as possible.

Advertising Environment

Here’s what’s happened to ad spending, in a nutshell.

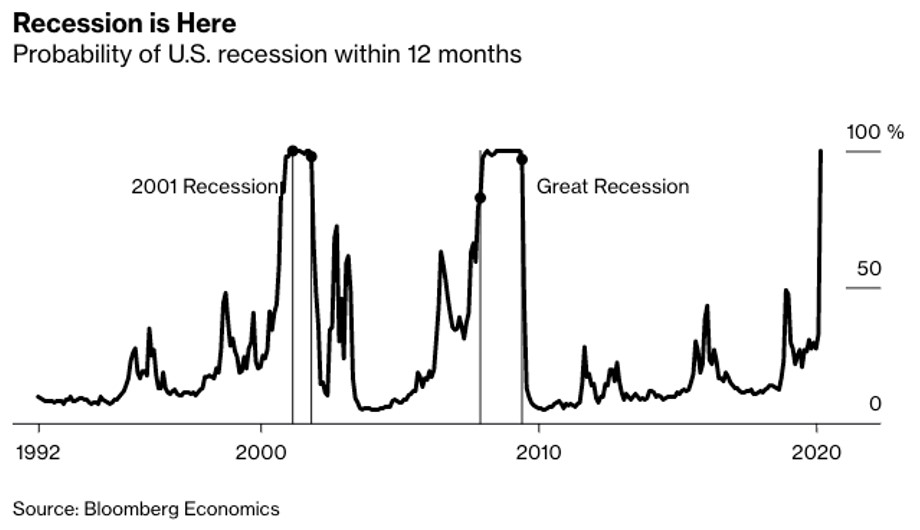

Findings from the IAB Coronavirus Ad Spend Impact report published on April 29, 2020.

Findings from the IAB Coronavirus Ad Spend Impact report published on April 29, 2020.

According to the IAB Coronavirus Ad Spend Impact report, 70% of media buyers have changed their spending habits with nearly a quarter having paused spending altogether.

Note there’s a sizable portion of marketers who don’t really know what actions they need or want to take.

Fully 16% are trying to figure out what to spend, where to spend it, and how to make the most of that spend.

The hesitation and confusion are understandable, but we want to limit that span of time as much as possible.

A large portion of marketers who are continuing to spend are making changes to the ad mix and the creative and messaging.

It’s a topsy-turvy world, and we’re all trying to make sense of it.

So what are we doing?

What Happens to Advertising During a Recession

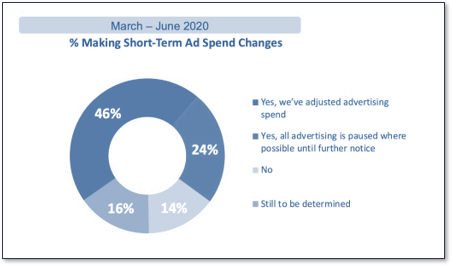

We’re sitting on a continuum.

On the left are the marketers who have stopped.

Most advertisers were on the far left of this continuum in March, not knowing what to do and so they just hit pause a big way.

Many have stayed here through April. That’s the 16% according to the above IAB report.

They’re continuing to live there now and may not move to the right out of necessity or fear.

But the advertisers who see opportunity in adversity are on the right.

They’re the ones buying up high-quality audiences, creative capacity, and ad inventory.

They’re looking at each portion of their ad process:

- Audience.

- Message and creative.

- The offer or CTA.

- Their media buying.

- How they’re measuring

They’re figuring out how to make the most of what they have given the circumstances their business faces.

Here’s why moving to the right is the right thing to do now.

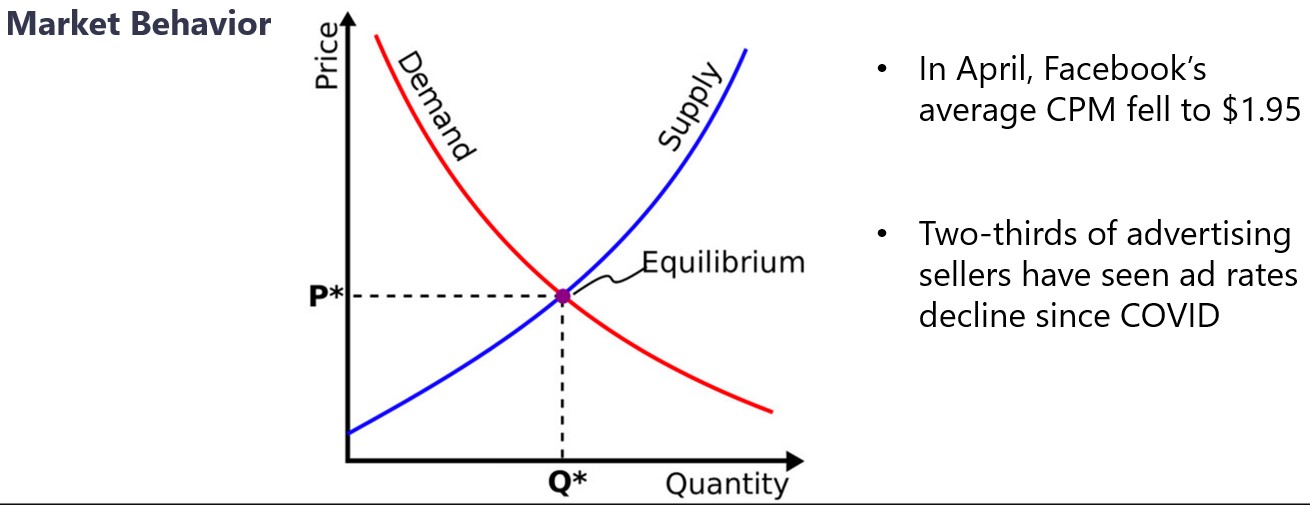

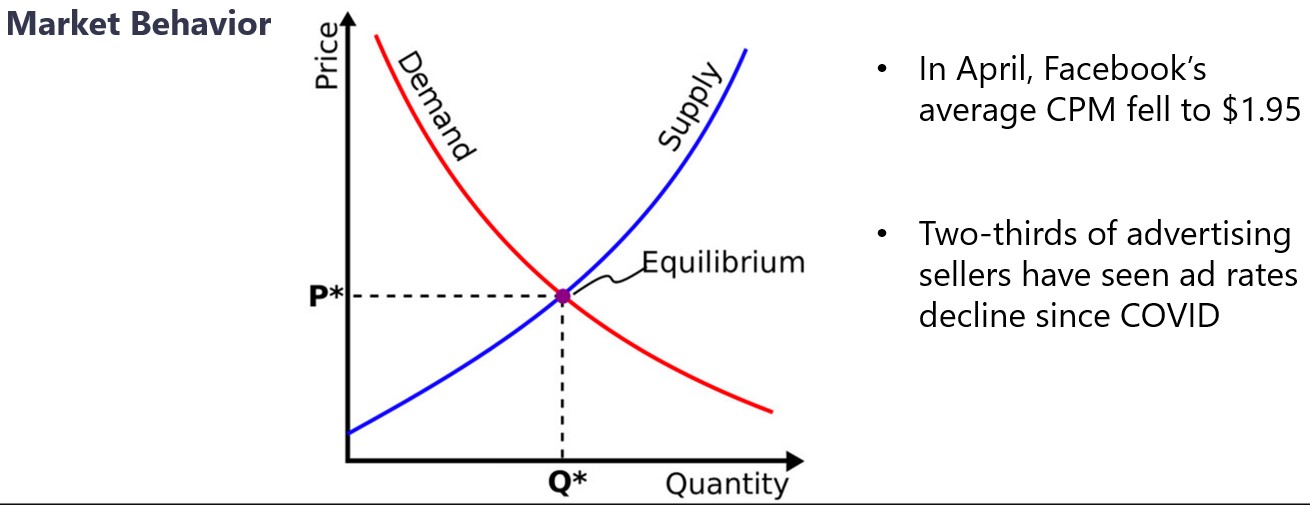

So let’s take a look at what happens to the advertising market when there’s a recession.

It’s a classic story.

Supply – in this case, ad inventory – goes up.

Demand – in this case, bidding and spending – goes down. And so prices go down, too.

While Facebook and Google aren’t giving ad space away, CPMs have dropped precipitously as companies have frozen, paused, or pulled back on spending.

In April, Facebook’s worldwide average CPM fell to an all-time low of $1.95, according to Gupta Media.

Two-thirds of advertising sellers – including publishers, platforms, and programmatic media sellers – have had advertising rates decline since the COVID-19 lockdown began.

So another interesting thing happens in this dynamic. In addition to prices dropping, noise also diminishes.

It becomes easier to stand out with strong, helpful creative.

New opportunities emerge that weren’t there even a few weeks ago.

We’re in an ideal spot in some ways where demand is still low, so prices are still optimal.

Once demand rises, prices will, too.

What History Tells Us We Should Do

Let’s take a look at what history tells us.

Great Depression (1930)

Fast-Moving Consumer Goods

Kellogg’s won during the Great Depression, while their chief competitor, Post, failed.

In the late nineteen-twenties, these two companies – Kellogg’s and Post – dominated the market for packaged cereal.

It was still a relatively new market: ready-to-eat cereal had been around for decades, but Americans didn’t see it as a real alternative to hot cereal until the twenties.

So, when the Depression hit, no one knew what would happen to consumer demand.

Post did the predictable thing: it reined in expenses and cut back on advertising.

But Kellogg’s doubled its ad budget, moved aggressively into radio advertising, and heavily pushed its new cereal, Rice Krispies. (Snap, Crackle, and Pop were a Depression-era creation.)

By 1933, even as the economy continued to crater, Kellogg’s profits had risen almost 30 percent and it had become what it remains today: the industry’s dominant player.

In 1930, in the spirit of clearly communicating what the company was doing to help the economy, W.K. Kellogg split worker shifts and hired new employees to work them, making an effort to employ more people overall.

He also founded the W.K. Kellogg Foundation, whose mission is to help children realize their potential, a great example of mission-based marketing.

1990-91 Recession

QSRs

In the 1991 recession, Pizza Hut and Taco Bell took advantage of McDonald’s decision to drop its advertising and promotion budget.

As a result, Pizza Hut increased sales by 61%, Taco Bell sales grew by 40%, and McDonald’s sales declined by 28%.

Great Recession (2008)

Autos

Hyundai created a unique and unprecedented program to remove risk for potential buyers during the Great Recession.

Its assurance program allowed consumers to return their new vehicle if they lost their job.

They pushed ahead with targeted ad buys, and sales rose 5% as much of the auto industry suffered drastic sales declines.

They differentiated the brand from competition by stating very clearly and compellingly that they had their buyers’ back. It was safe to buy a Hyundai.

What Experts Tell Us We Should Do

So the question now becomes: Is this recession any different?

With as rapid and as dramatic a decline as the job market has seen in recent history, should advertisers make any special considerations right now?

The IAB, the organization that develops industry standards for the online ad industry, says no.

This recession is going to be like previous recessions, by and large.

Here’s specific guidance the IAB provides as to how we ought to think about paid media and advertising investments.

IAB Coronavirus Ad Spend Impact: Buy-Side Trends, March vs. April

IAB Coronavirus Ad Spend Impact: Buy-Side Trends, March vs. April

What this chart is showing you is that the channels that allow the greatest amount of flexibility are the channels that make the most sense to invest in.

The two you can see here are social media and paid search because the ads there are easy to turn on and easy to turn off or pause as the case might be.

That’s where a lot of the money is flowing.

You can see down below while spending has still decreased considerably in digital audio and digital display, it’s not recovering as well in those categories either.

IAB Covid’s Impact on Ad Pricing report

IAB Covid’s Impact on Ad Pricing report

Across all channels, you can see here CPMs have fallen 16% and that is agnostic of channel.

You can also see where they’ve fallen precipitously and that’s in the top categories:

- Open web display.

- Mobile app display.

- Social media.

- AVOD free streaming sites/apps.

At the bottom, you’ll see channels where you’re going to pay what you’ve been paying where since ad rates have been most resilient:

- Podcasts.

- Video.

- Search.

So when you think about reinvesting in paid media, clearly there is a strong the case for social media and display.

Those are the channels that not only offer you the greatest deals right now, but they also offer you the greatest flexibility.

Flexibility is so important today at a time when none of our clients know what the world is going to look like next week, next month, next year.

What Stands Out

There are two advertising tactics that are standing out during this time due to their direct impact on getting shoppers back into stores.

Geotargeting at the Local & National Levels

Geofencing campaigns are highly effective in the current climate.

As you think about employing this tactic yourself, be sure you make use of location data that enables you to look back as far as you need to so you can bring the shoppers, diners, and patrons back who used to be regulars.

For example, you’re going to want to geofence specific locations and see who was there when shopping and dining were at normal levels.

Those are the audiences you want to reach with new messaging around re-opening, safety, special offers, etc.

Direct Buys with Premium Publishers

The growth here has not been as large, and this is mostly dominated by the large brand advertisers in specific consumer categories.

The IAB provides insights into medium and large companies.

But what about SMBs?

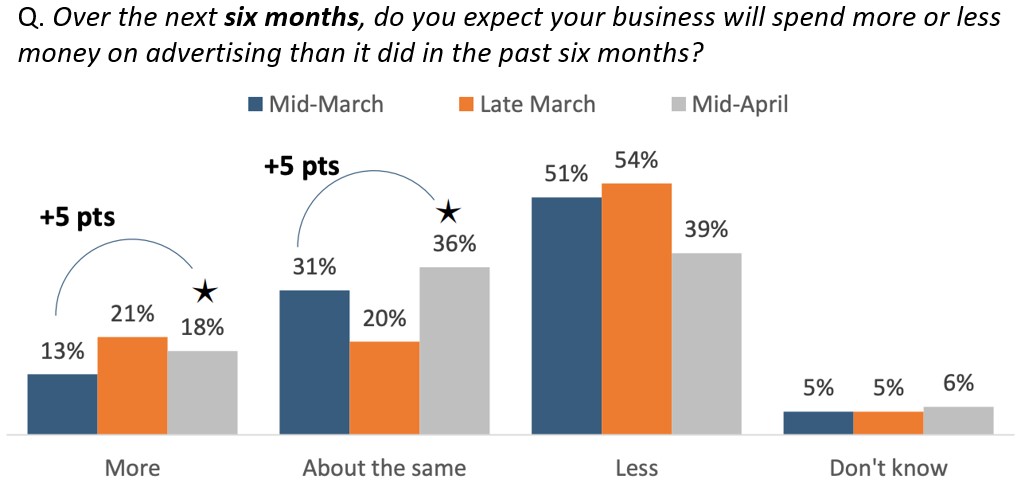

SMBs Are Growing More Optimistic

Borrell ran a survey recently asking small and medium businesses how they expect their ad spending to change over the next six months, the period when we’re going to see some of the most serious recessionary impacts to the economy.

Borrell Small & Medium Business Panel April 2020 COVID-19 Marketing Impact Study

Borrell Small & Medium Business Panel April 2020 COVID-19 Marketing Impact Study

There was a 10-point shift from late March to late April in SMBs planning to maintain or increase ad budgets.

60% applied for government assistance or a loan. One in five of those may use a portion of advertising.

What this data tells us is that SMBs are looking to start spending again in the near to mid-term, in the same way we’re all looking to get out of our houses sometime in the not too distant future.

And people are still going out. Consumer audiences are findable and addressable.

Large Pent-Up Demand

There’s a large amount of pent-up demand across a range of consumer segments.

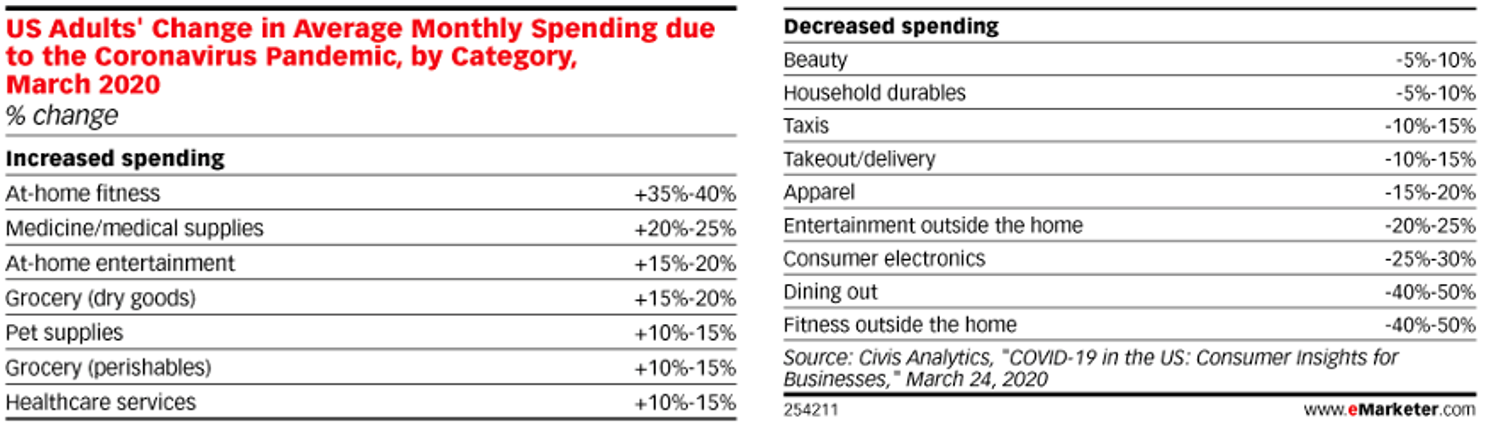

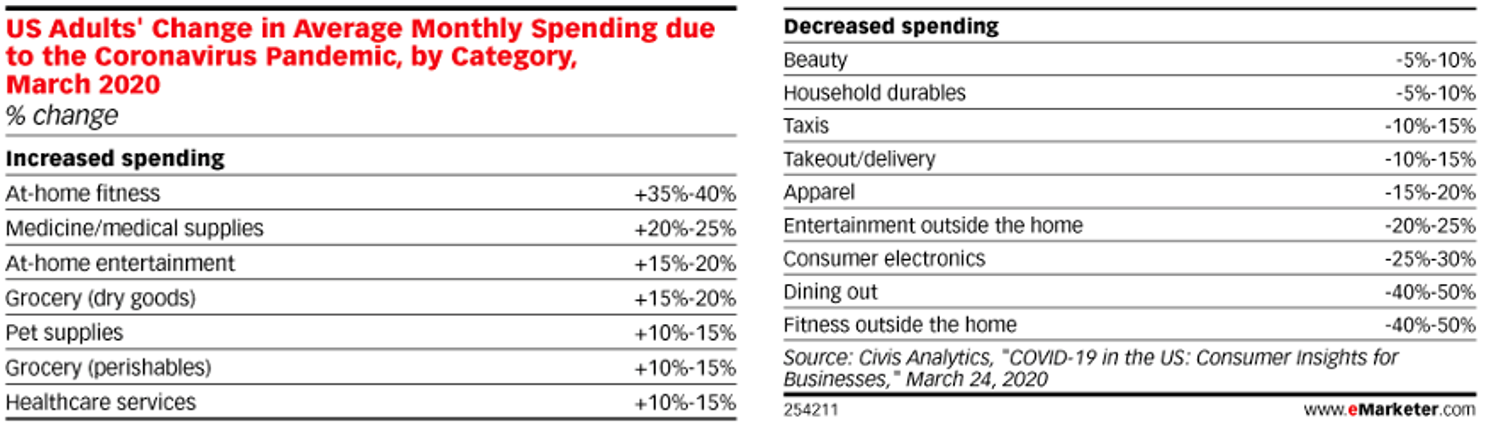

Emarketer reports that spending has gone up in categories related to staying at home:

- At-home fitness.

- Grocery.

- In-home entertainment.

- Etc.

And there’s been a commensurate decrease in spending in categories that are largely outside the home:

- Clothing stores.

- Restaurants.

- Cars.

- Etc.

It’s in categories where people are ready to spend their consumer dollars as they return to stores.

Many of them were non-essential businesses that have now re-opened and are looking to get shoppers back to their locations.

Market research tells us that fully 61% of consumers plan to visit apparel, shoe, and accessories stores.

After that, consumers want to get back to beauty stores (50%), followed by home improvement stores (42%), entertainment and hobby stores (39%), and home decor stores (34%).

Most consumers aren’t waiting to shop in-store.

Half of consumers say they plan to visit non-essential retailers within a week of reopening, while the other 50% will wait anywhere from a few days to two weeks.

As stores reopen, 58% of shoppers have said they’ll shop as frequently as before the pandemic, spending dollars that businesses have so sorely missed.

Case in point – as American Eagle stores reopen gradually, the apparel retailer says sales are averaging around 95% of their normal levels. American Eagle has opened 556 of 1,100 locations to date.

Audiences You Can Geotarget

1. Your Own Visitors

Perhaps the most intuitive use case for geotargeting is to ensure your message stays front and center with your current customers.

Building loyalty and strengthening retention are the goals here, and knowing who your real-life visitors are is the key to success.

What makes geotargeting your in-store visitors different than other forms of targeting is that you can capture those people who may not have purchased something or provided their email address.

Transaction data is useful, but location data allows you to be highly relevant to the visitor who may have just browsed.

Retargeting these visitors via social media and display advertising helps convert them to more regular visitors and shoppers who purchase more over time.

2. Your Competitors’ Visitors

With location-based marketing, you are not limited to geofencing your own locations.

Many see success in geofencing their competitors’ locations and serving ads to the audiences who visit those locations.

When it comes to geoconquesting, tactics and accuracy are critical components of success.

Imagine you operate a franchise of quick-service restaurants, and you are adding a new fried chicken sandwich to your menu.

To win over people who are most likely to become diners at your locations – using this new menu item as the draw – you want to advertise to everyone who has visited restaurants like Chick-fil-A, KFC, Wendy’s, Church’s, Zaxby’s or Popeyes in your area over the past three months.

Using location data, you can appeal to only those diners who have shown a high likelihood to try your new chicken sandwich.

3. Locations Your Ideal Target Visits

Whether you are an advertiser for a company whose foot traffic is not large enough to create a meaningful audience or you do not have physical locations and instead sell your products online, geofencing is a key strategy for you.

Imagine that an agency is tasked with increasing enrollment at a group of preschools.

The way to go about this is to target parents in the areas where the preschools are located.

To build the right audience – and decide on locations to geofence – the agency has to ask the question: “Where do my ideal parents go?”

Once this information is determined, the agency can geotarget the people who visit those locations and serve ads to those visitors, building awareness, and getting the preschools’ message in front of the right audience.

How to Find High-Intent Audiences When Foot Traffic Is Down

As businesses begin to reopen in phases and consumers begin to visit stores in greater numbers, it’s critical that advertisers optimize ad spend and reach the audiences they need to reach.

According to the IAB, geotargeting at the national and local levels have seen a marked increase in ad spend through April as marketers look to maximize paid media investments.

Grocery Store Visitors

Brands that offer grocery or home goods delivery can target people shopping in grocery stores.

Building an audience made up of those who are visiting grocery stores ensures you aren’t spending ad dollars on those who are already shopping online.

Alternatively, you can offer online grocery shopping to those who are still doing in-store shopping.

Just this week, Costco actually began promoting its “In-Warehouse Hot Buys” – deals plugged via email and on their website.

There are caveats that “warehouse merchandise is subject to limitations or prohibitions imposed by applicable emergency orders.”

People are going out to shop, even just to get out of the house, grocery stores can make or break their next quarter based on how they market.

Home Improvement & Hardware Store Visitors

People who are shopping at home improvement stores are getting to their household projects list.

These people are ideal targets for brands that sell complementary items like furniture and decor.

Has the container gardening craze hit your part of the world yet? If not, it’s definitely on its way.

Home improvement store shoppers are DIYers, so they may also be an effective audience for craft-oriented brands to target as well.

Parks & Trail Visitors

For outdoor apparel, exercise equipment, and even gyms, once they’re permitted to reopen, people who visit public parks and trails are likely to value physical fitness.

Targeting visitors to parks and trails is the right audience for these types of brands.

Marketers who advertise vacations for outdoor enthusiasts or destination travelers, such as national parks or the Grand Canyon, could also find value in an audience of visitors to parks and trails.

Pet Supply Store Visitors

Just like grocery stores, pet supply stores are essential businesses.

Advertisers who want to target pet owners can easily find an addressable audience from pet supply store visitors.

Pet food brands, groomers, even pet adoption organizations could target this in-market audience.

Liquor Store Visitors

On the liquor store front, we all know Americans’ consumption of alcohol has increased during the COVID-19 outbreak.

According to the New York Post, spirits sales in the U.S. are up 75% over last year and wine and beer sales are up 66% and 42% respectively.

Liquor stores are busier than ever.

Targeting people who visit liquor stores makes a meaningful audience for advertisers of online alcohol sales.

It’s also an ideal audience for local breweries and wine makers who want to promote their in-store brands and labels.

This is a prime opportunity to find new customers and keep up with current customers.

Truck Rental Location Visitors

U-Haul and other rental truck companies are open to support those who are moving. Yes, people are still buying and selling houses.

As some states reopen and open houses reemerge, buyers are returning to an already active housing market much faster than expected.

As of writing, mortgage applications just rose for the fourth straight week, jumping a healthy 11% last week.

Coupled with interest rates being low, people buying need moving trucks, equipment, and supplies.

Those who are visiting truck rental centers are those who likely need household essentials – furniture, dishes, paint, lawn and supplies, bedding, home decor, and the like.

Advertisers for low-cost household items such as trash cans, shower curtains, and paper towel holders can benefit from these audiences as well.

Messaging Your Audience Wants & Needs

We’re way past the message of “We’re here for you.”

What your audience wants and needs to hear from you are messages that:

- Provide answers.

- Assure safety.

- Offers clear and direct communication.

- Addresses a path to returning to “normal”.

Q&A

Here are just some of the attendee questions answered by Dan Dillon.

Q: What method do you recommend for geofencing a brick and mortar store?

Dan Dillon (DD): To geofence brick and mortar stores, you need two things: precise location data (PLD) and a point of interest (POI) database.

Luckily, there are software vendors who’ve solved this problem for you.

VISIT Local by Reveal Mobile is a great place to start. Using VISIT Local, you can build location-based audiences right down to the building level.

You can even draw custom geofences inside VISIT Local in the event the location you want to geotarget doesn’t already have a geofence around it.

When you geofence at the building level, you can run highly-effective campaigns targeting specific, high-intent audiences.

Imagine marketing a group of restaurants to everyone who has visited them and competitive locations just like them over the past six months.

That’s the kind of highly effective campaign you can enable with VISIT Local.

Q: We use geotargeting with paid Google ads within the United States. Is this a good way to geotarget?

DD: This is a great way to get started with geotargeting. As you say, it’s good for targeting at the country, state, and city levels.

But if you want to target at the brand, chain, retailer, or store level, you need to use a product that makes use of privacy-compliant precise location data (PLD).

Q: Do you have suggestions for finding high-intent audiences in the arts and culture sector? Our industry has been hit hard and having some suggestions would be super helpful.

DD: This is a segment of the economy that I hope comes back very soon!

To find audiences who are in-market for arts and culture, you can use precise location data to look back to see audiences who visited your locations before the COVID-19 outbreak.

That way, you’re able to reach audiences who are most likely to visit as you re-open or re-start performances.

You could also geofence high-end retail and restaurants, where your patrons likely shop and dine. These audiences are fully accessible to you in VISIT Local by Reveal Mobile.

[Slides] How Agencies & Advertisers Can Make the Most of Paid Media Right Now

Check out the SlideShare below.

Image Credits

All screenshots taken by author, June 2020

Sorry, the comment form is closed at this time.