16 Dec Profit per Click: What It Is & Why You Should Track It via @DigitalSamIAm

What is one of the biggest challenges faced by all performance marketing stakeholders – agencies, marketers, brands, investors, and executives?

Consistently and correctly quantifying the value created for the enterprise via marketing initiatives.

To put it succinctly: answering the age-old questions of, “What’s the ROI on our marketing?”

Or, more simply, “What’s working and what isn’t working?”

Do Even the Best Marketing Metrics All Fall Short?

Marketing platforms have historically offered marketers various types of data to support this effort including:

- Advertising cost data (CPC and/or CPM).

- Intermediate performance data (clicks, impressions, etc.).

- Revenue/value data (Conversions/Leads, Conversion Value, Transaction Revenue, etc.).

These base metrics are then combined to form rate metrics (Cost Per Click, Revenue Per Click/Value Per Click, Conversion Rate, etc.), which form the basis of performance evaluation today.

The justification for relying upon these metrics appears sound at first glance – after all, isn’t maximizing revenue a solid strategy?

(After all, what good capitalist is going to say “no” to maximizing revenue?)

And if maximizing revenue/value is good, then doesn’t it follow that Revenue/Value per Click (“RPC”) is a solid directional indicator that the program is performing well?

Mathematically, there are three vectors to increase your RPC:

- Increase the conversion rate of traffic.

- Increase the average order value (“AOV”) or average lead value or

- Decrease the cost per click (either directly, if buying CPC, or indirectly, if buying CPM).

Each of these would seem to be positively correlated with improved business performance.

Isn’t converting people at a higher rate good? Isn’t selling more stuff/driving more leads a good thing? Isn’t reducing your CPCs/CPMs positive?

The answer to each of those questions is a resounding “maybe.”

To understand why it’s important to remember that the overall goal of a business isn’t just to sell more stuff or acquire more customers; it’s to do those things profitably.

While it’s nice to understand how much revenue a given campaign or keyword is driving for the organization, I’ve worked with plenty of organizations with huge revenue numbers that collapsed faster than Anakin Skywalker in “Revenge of the Sith”.

The issue is that even the best of the metrics referenced above (likely Revenue Per Click & Conversion Rate, but arguments can be made for the relative import of all of them) falls well short of what’s required for creating a robust, defensible evaluation of any marketing program or campaign.

To see why, consider the following scenario – which I’ve found working for brands of all sizes (and in all industries) over the years:

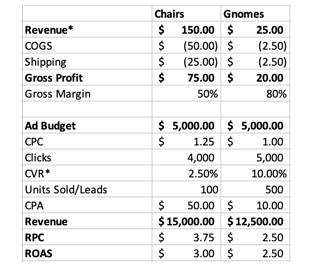

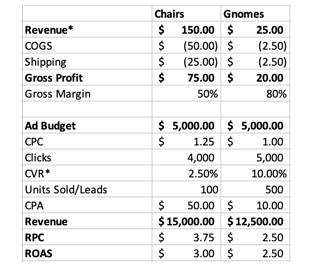

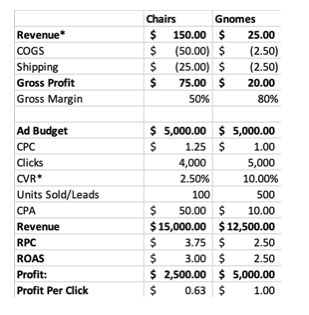

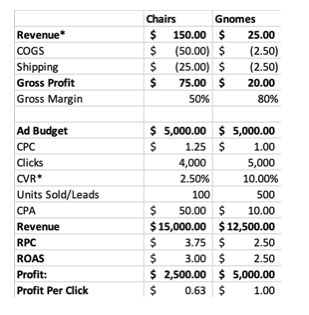

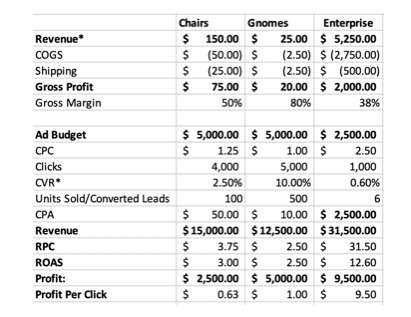

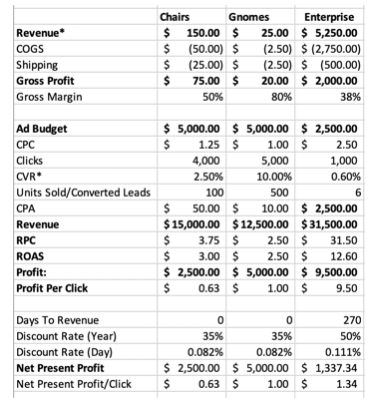

ACME Outdoor Company sells two products: garden gnomes for $25 and lawn chairs for $150.

It costs them $2.50 to manufacture a gnome and $50 to manufacture a chair (they’re of the nice, Adirondack variety). Shipping a gnome costs another $2.50, while shipping a chair costs $25.00.

Now, before factoring in advertising costs, holding costs, agency fees, or interest charges, ACME has a gross profit of $150 + ($50) + ($25) = $75.00 on chairs and $25 + ($2.50) + ($2.50) = $20.00 on gnomes.

(For simplicity, I’m using financial/accounting notation for negatives balances, which calls for negative numbers – such as deductions or expenses – to be shown in parentheses. Thus, ($50) is the same as -$50).

Let’s assume that ACME spends $10,000 per month on advertising for their business (both gnomes + chairs).

Most automated bidding algorithms will try to maximize your conversion value (revenue in this case) or Return on Ad Spend (ROAS) (depending on your bidding strategy) – likely by pushing customers to the higher-revenue chairs vs. lower-dollar gnomes ($150 vs. $25).

But this isn’t always the correct approach, as we’ll see:

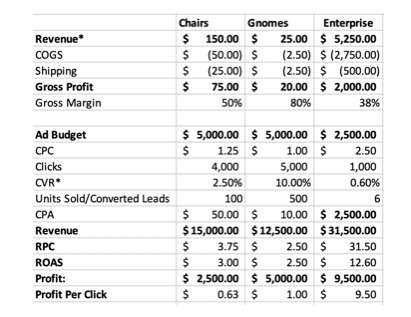

In the above case, it appears (by both RPC and ROAS) that lawn chairs are out-performing the gnomes – driving a ~50% higher RPC, ~20% higher ROAS, and ~20% more revenue on the same spend.

While gnomes convert at a much higher rate (to be expected for a low-dollar item vs. a more expensive one), the logical recommendation from this data is to invest more money into the lawn chairs campaign, right?

Well, not exactly – because this analysis does not include the costs of goods sold (COGS) or shipping costs that ACME incurs in order to produce and distribute their goods.

When those are included, a different picture emerges. To do this, we’re using what I’ve termed Profit Per Click (“PrPC”), which is calculated with the following formula:

PrPC = (Gross Revenue – Costs of Goods Sold – Transaction Costs – Fulfillment Costs)/Clicks

In the above example (and for simplicity), I’ve omitted the transaction costs (i.e., credit card processing fees, PayPal fees, bank transfer fees), which typically represent anywhere from 0.5% to 3% of the total transaction.

As you can see from the above, ACME’s profit per click for chairs is ~37% lower than the profit from gnomes – driven by that item’s significantly higher gross margin (80% vs. 50%).

If ACME were to take the RPC recommendation from above and invest more into lawn chairs, the company could leave up to $5,000 in profit on the table ($10,000 is the max profit for investing 100% budget into gnomes; $5,000 is the max profit for investing 100% budget into lawn chairs).

Yikes.

While many commerce marketers would (rightfully) say that the above analysis is incomplete – especially since many gnome buyers might also buy a lawn chair or vice versa – the underlying principle illustrated still holds and is easily translated into these scenarios.

The beauty of Profit Per Click is that profitability is sufficiently granular (it applies at an outcome level) to enable analysis at all levels of your performance marketing initiatives – from the keyword or creative level to campaign or account level.

This enables marketers to find hidden sources of value while aligning their efforts to the overall organizational goal (namely, more profit).

Likewise, the above scenario also excludes fixed costs (like agency retainers or 3PL monthly fees or sales team salaries, for lead generation businesses vs. direct commerce), all of which are easily incorporated and sufficiently granular.

While profit per click is not included (by default) within a web analytics or digital platform, integrating it is quite simple.

- Via COGS within your product feed (here’s a helpful link) for commerce businesses.

- By uploading cost data within Analytics (more info here).

- By reducing conversion values/adjusting lead values within Ads, based on the relative profitability of those outcomes.

As this discussion shifts toward leads and future revenue, the limitations of Profit Per Click become more apparent. Namely, non-commerce transactions typically have a longer lag between the conversion event and money in the bank.

There’s sales follow-up, proposal submissions, and revisions, contract negotiation, pricing discussion, invoicing, payment terms, and the like.

For many larger B2B deals, the lag between a lead in the door and money in the bank can exceed 6 months – which is an awfully long time to hold inventory (or worse, have shipped inventory and be waiting for a check).

A similar problem emerges for DTC brands or ecommerce transactions, as the initial sale typically represents only a fraction of the customer’s lifetime value (LTV), or 30/60/90-day cash (depending on which model you choose).

In either case, our Profit Per Click (“PrPC”) metric is providing a materially deficient picture of what’s happening, potentially with dire consequences – the DTC graveyard is littered with tombstones of brands who died waiting for LTV to materialize.

This shortcoming also exists with PrPC, which will not capture this critical nuance because it assumes an instantaneous value transfer/immediate revenue recognition.

This can lead to a skewed picture of the business’ situation – and potentially, a cash crunch or lifetime value trap, as the business continues to incur expenses (operating expenses, COGS, salary, interest, etc.) while waiting for the potential revenue.

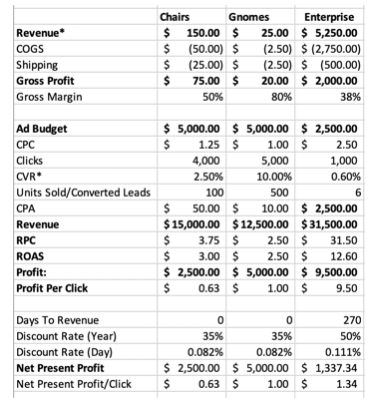

If we assume that ACME (from above) has a third line of business, Enterprise Sales, where the company sells lawn chairs in bulk to colleges, universities, municipalities and the like, we can see this issue materialize.

For the sake of simplicity (and for easier comparison with direct commerce), I have discounted the conversion rate + revenue per lead to account for non-qualified conversions (leads that do not materialize into actual customers, for whatever reason).

One of the first thing that jumps out is the significantly higher Profit Per Click for the enterprise clients (~9.5x higher than gnomes, ~14x higher than lawn chairs, and more revenue than both lawn chairs + gnomes combined, despite a campaign budget that’s 25% of gnomes and lawn chairs, combined).

From these numbers, it appears that Enterprise offers a substantial opportunity for ACME to increase overall profitability – after all, look at that ROAS!

Over the years, I’ve noticed a similar phenomenon for businesses with similar, bifurcated models (from DTC to SaaS to professional services and consumer goods).

This conclusion is sometimes valid, but sometimes not – with the three factors playing a major role in whether it’s worth it to invest more in marketing the “prima facie“ more profitable enterprise/lead generation business bifurcated:

- The time from lead-to-close.

- The conversion rates on leads to customers.

- The relative volatility of (1) and (2).

As an aside (especially for many smaller businesses), (3) is often completely ignored, despite it being (arguably) the most important.

After all, if you don’t know when to expect cash in the door (or roughly how many leads you’ll close), your operational risks go through the roof.

- How do you know how many units to keep in inventory?

- When you can expect to know if there’s a problem with your sales team?

- How to structure your financing?

- Whether to pull the plug or increase marketing?

These are serious, often existential, questions that far too many businesses ignore, at their own peril.

While this article is primarily about assessing marketing performance, any good marketer ought to be a good businessperson first.

If your current partners aren’t asking these kinds of questions, that’s a red flag that it’s time to find a new partner (or do some education of your in-house team).

Fortunately, we have a tool that can help us assess how we should balance these factors: a net present value calculation.

What Is Net Present Value

Net present value is a method of adjusting future cash flows (positive and negative) based on the time-value of money and risk profile, using a discount rate.

In short, NPV tells us what a potential future cash flow is worth today.

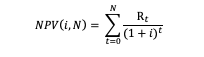

NPV for the (period, cash flow) pairs (t, Rt), where N is the total number of periods is given by the (scary looking, but pretty simple) formula:

Where Rt = is the net cash flow (inflows less outflows) at each time t and i is the discount rate.

What Is Discount Rate

The discount rate (sometimes called the discounted rate of return) is an interest rate that reflects the opportunity cost (or cost of capital) and risk associated with a given investment.

Cost of Capital: Every capital outlay made by an enterprise is zero-sum – if funds are used for A, they are not available for B (and vice versa).

In short: accessing capital isn’t free for any company – funds must either come from a credit facility (which comes with interest costs, future liquidity risks, and obligations) or from equity (which dilutes ownership, incurs underwriting costs, and potentially poses other risks).

Other Risks: there are other risks involved in any investment decision, above and beyond the cost of capital.

For instance, an investment in marketing today is not guaranteed to yield a lead (or sale) tomorrow.

The timing of cash flows from those deals is often uncertain, as is the ability of an enterprise to fulfill a future order. These risks must be considered alongside the cost of capital when assessing what a potential future cash flow is worth today.

For many companies, the discount rate combines their Weighted Average Cost of Capital (WACC) plus an additional risk premium, based on the nature of the investment (i.e., investing in marketing is riskier than buying a new machine, and thus the marketing investment would have a higher discount rate).

This results in an annual discount rate ranging from ~10% (for large, public companies with robust access to capital) to ~50%+ (for smaller companies and start-ups, with no access to capital).

Finally (and critically), the discount rate is not fixed.

Different rates can be applied to cash flows based on when they occur – so a higher discount rate can be applied to cash flow 6 months from today (which is far less certain to happen) and a lower discount rate applied to a cash flow 30 days from now (which is far more certain).

This robustness makes the discount rate method incredibly valuable for all organizations (and avoid many of the pitfalls of cash multipliers and straight-line LTV calculations).

Applying the NPV Formula to ACME’s Enterprise Business

Since our enterprise transaction is really just a pair of cash flows (an initial outflow at t=0 to pay for advertising and provide the product, followed by a subsequent inflow at a future point when ACME is paid by our customer for the chairs), this calculation is simple.

For the sake of simplicity, I’ve used 270 days (~9 months) from the time the lead is received to the date when funds are deposited. For some businesses, this is actually pretty short; for others, this may seem way too long.

The beauty of an NPV calculation is that it is endlessly flexible – you can adjust this to meet the unique needs of your organization.

Additionally, as my (hypothetical) ACME company is relatively young and small, I’ve selected a discount rate at the high end of the range discussed above of 50%.

While this sounds high, it’s typical for smaller companies with limited access to capital and fledgling operations.

(It is important to remember that many startup companies are financing operations on credit cards with interest rates above 25%; a discount rate must take into account not just this interest rate, but also the fact that the investment is far from guaranteed to produce a return. Conservatively, an investment made using funds borrowed at a 25% interest rate with a 50/50 chance of yielding a return easily justifies a 50% discount rate.)

Thus, for a single lead for ACME Enterprise Lawn Chairs:

At t=0, using a simplified calculation, with the budget ($2,500) divided by the number of leads (6), we incur an expense (cash outflow) of $2,750 (COGS) + $500 (shipping) + $416.67 (advertising) = $3,667.67.

Plugging this into our formula, the NPV of this is:

NPV of Initial Outlay = ![]() = –$3,667.67

= –$3,667.67

Then, at t=270, we receive a cash inflow of $5,250, which represents the payment by our customer for the goods provided.

NPV of Cash Inflow = ![]() = $3,889.56

= $3,889.56

Summing these together, we realize a Net Present Profit of ($3,667.67) + $3,889.56 = $221.89 – that’s over $1,360(86%) less than what a straight-line (revenue minus expense) analysis suggests.

Why?

Because there is significantly more risk involved for ACME Corp. on the enterprise deals, as the company is outlaying a significant amount of money immediately (to hold and fulfill orders, plus pay salespeople, attorneys’ fees on contracts, etc.), but not realizing revenues until much later.

Let’s put everything together in order to get a single metric that accounts for the risks, uncertainties, and opportunity costs we’ve discussed and allows us to make an apples-to-apples comparison of our marketing performance for each business line and campaign: Net Present Profit Per Click (“NPPPC”):

NPPPC is calculated by multiplying the output of the above NPV formula by our conversion rate:

When NPPPC is used in place of RPC or ROAS, the enterprise campaign still looks good, but it doesn’t look phenomenal – and intuitively (at least in the minds of many business owners), this is right.

While the revenue numbers from the larger enterprise sales are appealing, the risk associated with realizing them is real and significant.

Accounting for this is absolutely critical for all performance marketers – remember, we should be businesspeople first, marketers second.

The beauty of NPPPC is that it can be incorporated within Google Analytics as a custom metric and it is sufficiently granular that it can be used to compare the performance of different keywords, campaigns, channels, and tactics, all while being defensible and intelligible to all stakeholders within the organization.

This same method can be used to calculate (for instance) the value of a SaaS consumer (each month is a separate cash flow; these can be more or less risky depending on your churn data) or more accurately portray a DTC brand’s financial position than a 30/60/90-day cash multiplier.

Likewise, the NPPPC model can be adjusted to account for different levels of risk with different product lines, customer personas, or service offerings; it is sufficiently granular and endlessly flexible.

Limitations of Profit per Click

While I firmly believe NPPPC is one of the most robust metrics out there for performance marketers, it is still critical that we remember Goodhart’s Law: whenever a metric becomes a target, it ceases to be a good metric.

For instance, if we measure performance by the number of leads generated, we’ll end up optimizing for lead volume while ignoring cost, potentially leading to losing money on every lead – not a good place to be!

While it is objectively good to maximize NPPPC, doing this in isolation can have negative effects (i.e., maximizing NPPPC might result in fewer leads, which limits overall growth of the organization).

It is always a good idea to create metric trios – usually consisting of one granular performance metric (NPPPC), one scale metric (net present profit, or profit, or revenue), and one historical comparison metric (YoY growth target; PoP growth target, % to projection, etc.).

There’s a natural tension between each of these metrics, such that maximizing one likely has a negative impact on the others – helping to ensure that we don’t veer too far in any direction and compromise the overall health and profitability of the organization in the process.

More Resources:

- 10 Important PPC Trends to Watch in 2021

- How to Interpret PPC Data Correctly (Even If You Never Studied Statistics)

- PPC 101: A Complete Guide to PPC Marketing Basics

Image Credits

All screenshots taken by author, December 2020

Sorry, the comment form is closed at this time.