22 Dec What Search Marketers Need to Know About Criteo’s Retail Media Platform via @ebkendo

If you’ve been in the paid search industry for a few years, then you’ve probably heard about Criteo – or even used it.

You might also be familiar with Criteo Retail Media from back in the days when it could be described as an ad network for sponsored products, circa 2016 when Criteo acquired a company called Hooklogic.

Hooklogic had built a business by aggregating inventory across many retailers and enabling brands to bid on that inventory on a CPC basis.

In addition, you may also know that Criteo acquired a company called Storetail in 2018, to help retailers offer new creative formats and targeting options.

But what you might have missed is the announcement of Criteo’s new Retail Media platform.

For now, I’m going to stick with this sponsored products piece and the platform that powers it, as that represents an easily attainable action item going into not only holiday, but 2021 planning.

So, let’s dive into what the Retail Media platform does for sponsored products.

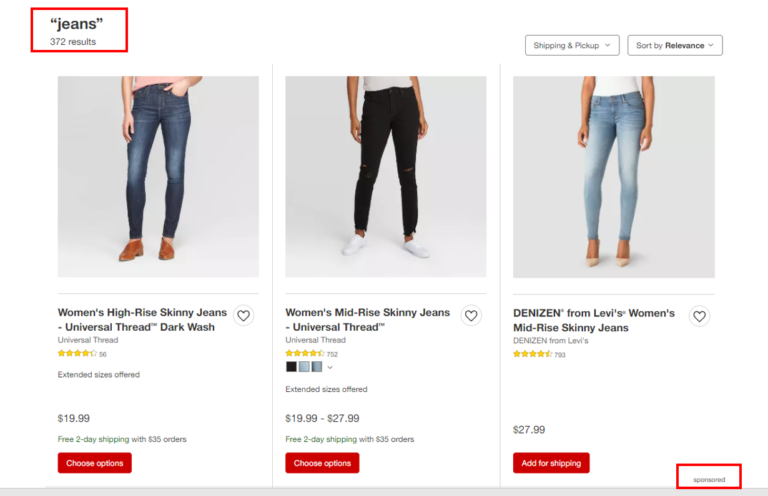

This technology enables retailers to serve ads that blend into the existing site structure, look and feel. It allows the retailer to “sell” placements in search results, browse pages, and anywhere else they feel a sponsored product placement will align with user expectations.

So retailers can focus on being retailers, not an ad management platform or software developers, enabling them to get to market faster with advertising offerings, without absorbing the costs of owning, maintaining, and building out an advertising technology stack.

Which is, if you stop to think about it, an extremely large and expensive set of tasks to get done right.

The other thing that this format does is provide brands with an always-on option for advertising with that retailer.

Traditional retailer advertising can be very heavily administrative-based, even with online-only display flights, with insertion orders, large budgets or minimums, weeks of planning around creative assets and review, lockout periods, and post-campaign reporting, that can’t happen until the full attribution period has passed.

While these larger display buys can get you attributed in-store lift, basket analysis, and brand halo effects – it can take eight weeks post-campaign end to get it.

Criteo now works with retailers in North America to provide enterprise-level self-service advertising tools to brands, including Target, Best Buy, Costco, Meijer, Macy’s, Kohl’s, Walgreen’s, CVS, and Ulta.

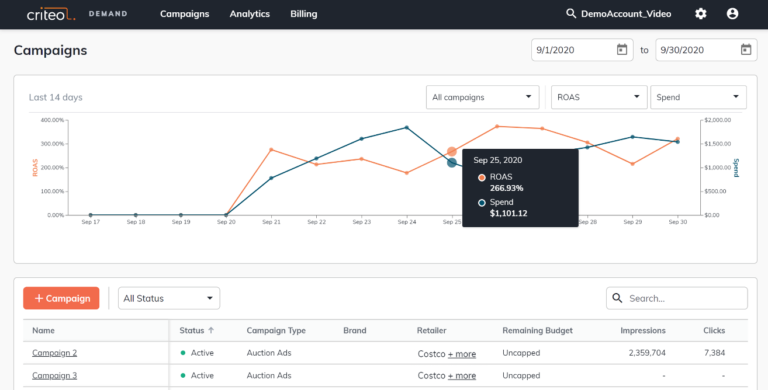

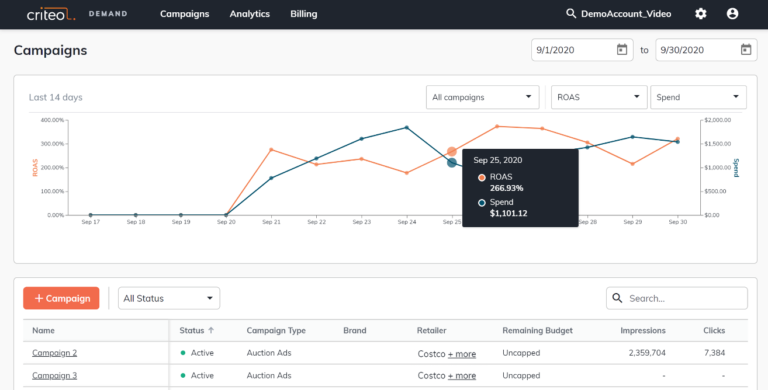

What’s awesome with the Retail Media platform is that the advertiser can choose for their ads to appear on a single retailer, or to run a campaign with multiple retailers and still break down reporting at the individual retailer level.

Brands can use budget caps to allocate budget to different retailers at the levels needed, or leverage AI to allocate funds dynamically to achieve the best return on ad spend.

Some retailers, like Target, already used Criteo for an exclusive environment they call “Private Market” in which the ads are shown only on target.com.

Being able to target only Target (pun intended) is really valuable to brands who want to push more sales specifically at target.com or even leverage product popularity to a need for more physical shelf space, assortment expansion and also for those Target Plus sellers in the marketplace that need to promote their products and do not have in-store presence.

How It Works

Sponsored products via Criteo is a CPC model and a first-price auction.

It’s not keyword-based. The focus is more on the individual SKUs.

All SKUs have keywords already associated with them, thanks to information from retailer product feeds, data collected from retailer sites, and Criteo’s AI.

Brands do not have to then devote resources to developing creatives.

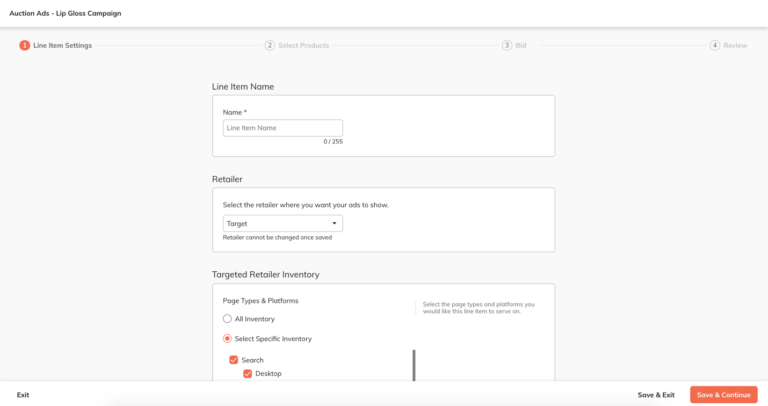

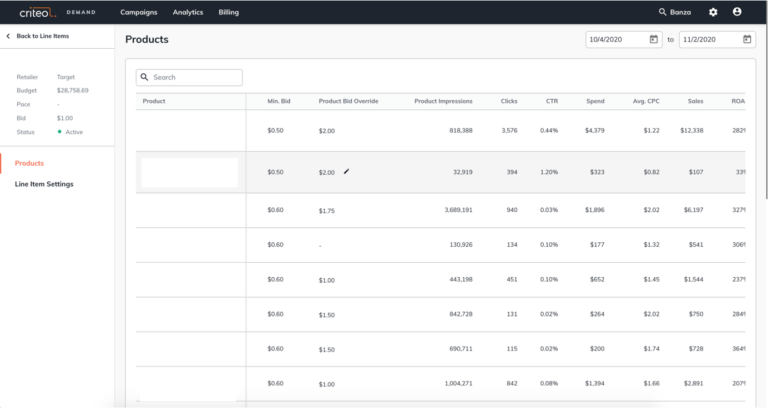

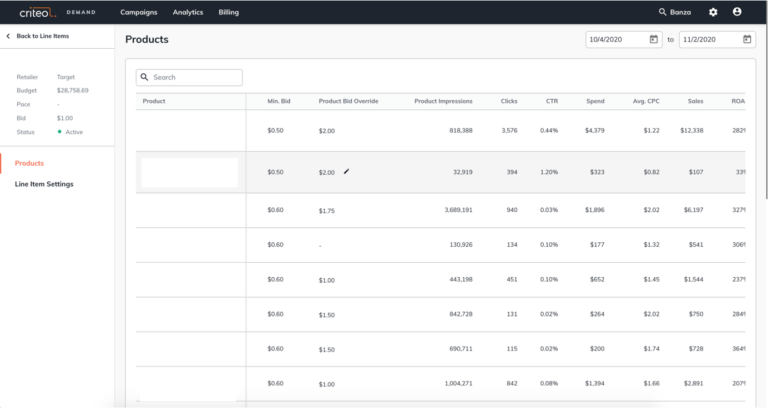

Bids can be set at the line item level and at the SKU level. The concept of a line item is actually new in the Retail Media platform.

In the past, you had to sub-divide campaigns using “product groups” to group SKUs.

Now, you create line items, and each serves as a tactic to fuel the strategy of your larger campaign. You associate a retailer with each line item.

This allows you to have control over where your budget is going, as well as see retailer-level reporting.

In addition, the SKU-level bidding feature enables you to now manage CPC bids on individual products.

By adjusting a product’s bid, you can adjust the product’s competitiveness in the auction.

Through the in-line editing tool, you can enter and save a new CPC value for each product in the Product Bid Override field. The value entered needs to either be equal to or greater than the minimum floor bid.

Another difference in the new platform is that these floors are now set by the retailer, so they can vary quite a bit within categories. Previously minimum bids were set by Criteo for their run of network campaigns.

Once entered, the product will use the new CPC value for bidding. Products that don’t have a Product Bid Override value specified will automatically use the line item bid.

With this new campaign structure, there is a lot more flexibility in organization. For example, you can have a campaign with one line item for one retailer.

You can also have a campaign with 10-line items, each with a different retailer. Or you can have 100 SKUs on a line item.

Each line item has a start date and an optional end date. (Start and end dates are not at campaign level.)

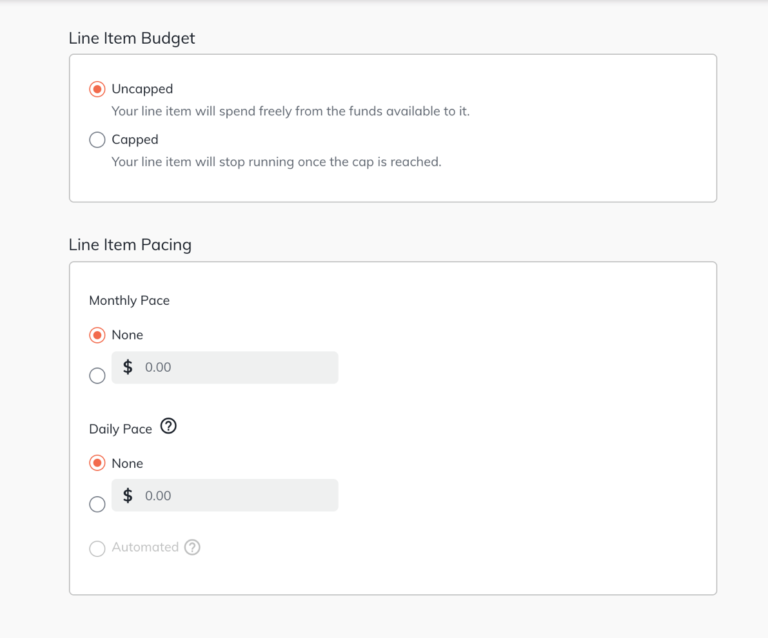

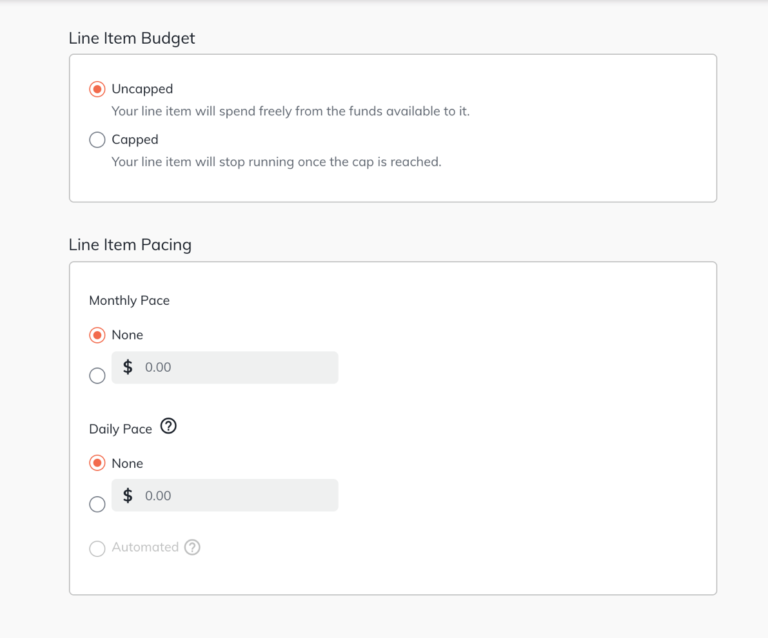

You can choose to set a budget for the line item, as well as use daily or monthly pacing tools. Or, you can choose not to set a line item budget, and rely on the budget set at the campaign level.

Your choice.

While daily and monthly budget pacing was moved from the campaign level to the line item level in the new platform, attribution is now at the campaign level rather than the account level.

In addition, Criteo is now providing several more attribution options. Previously, you could only do 30-day post-click and 1-day post-view. Options now include Post-Click: seven days/14 days/30 days and Post-Viewed: None/one day/seven days/14 days/30 days.

Brands can now align with the attribution windows they are using with other platforms if they so choose.

Reporting

As mentioned, brands can now view retailer-level reporting. In addition, Criteo is normalizing metrics across retailers, making it easy for you to compare performance across retailers.

The new platform also includes data visualization, so you can now slice and dice with customizable reports with the metrics you want.

You can download reports directly from the UI, or schedule reports via email.

How to Get Started

Technically, there aren’t any spend minimums to gain access to the Retail Media platform.

However, pricing on the platform varies depending upon spend commitments and if you choose to leverage Criteo’s managed service team for management support.

With the launch of this new platform, Criteo has also evolved its pricing model to offer full transparency to brands, agencies, and retailers.

The new pricing model aligns with media and cost pricing that is used by other media buying tools and creates more transparency and flexibility to pay for what you use.

I highly recommend checking out the “Consumer Product Brands: It’s Time to Take Control of Your Retail Media Destiny” report conducted by Forrester, commissioned by Criteo. The full report is available for download and covers the landscape of retail media as it is today. And you can check out where you sit against the respondents and their maturity into retail media as a part of their process and optimization.

It will cost you an email to get it, but I thought it worth it. And if not, there is plenty of other material in the Resources section. From there, you can contact Criteo to get started.

More Resources:

- Sponsored Products with Walmart Media Group: What Sellers & Marketers Need to Know

- Why You Need a Holiday Social Media Advertising Strategy Right Now

- Ecommerce Marketing: The Definitive Guide

Image Credits

All screenshots taken by author, December 2020

Sorry, the comment form is closed at this time.