23 Mar What Search Marketers Need to Know About Instacart Advertising via @ebkendo

There’s no way that you’re on a site called Search Engine Journal and you haven’t heard about Instacart. So, you’re already one step ahead of the game.

If you didn’t use Instacart before the pandemic, odds are you’ve used it once or twice (or 12 times or more) over this past year.

What you may not know, however, is that Instacart is a rising behemoth in the retail advertising world, muscling in on the turf traditionally held by the big guys such as Amazon and Walmart.

Instacart is already the undisputed leader in online grocery delivery in North America and they’re also expanding their delivery and pickup services beyond supermarkets.

If you have a product sold in any brick-and-mortar store, you’re going to want to explore the advertising options available with Instacart.

For context, in May of 2020, Instacart launched a self-service advertising platform. Prior to that, the company had been conducting onsite advertising options in a more manual, flight-based manner.

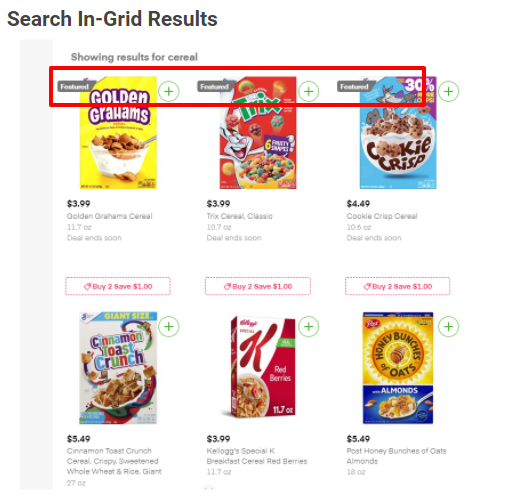

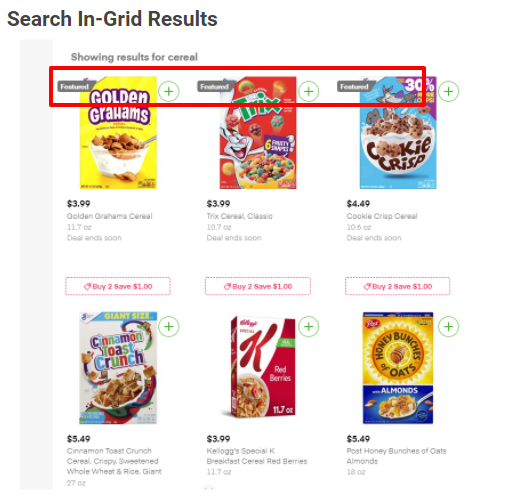

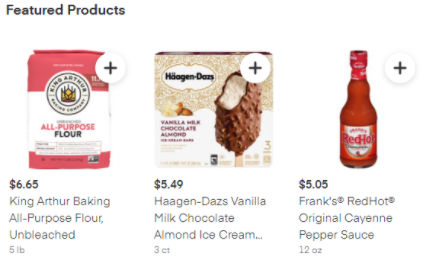

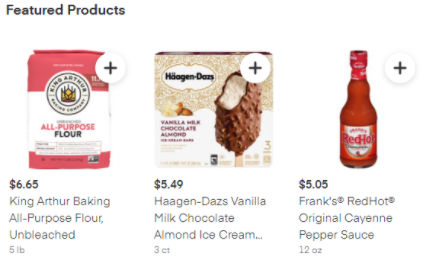

They still offer some of those choices, especially around coupons, banners, and larger promotions. But the very user-friendly and effective “featured (sponsored) products” are what we’ll dig into today.

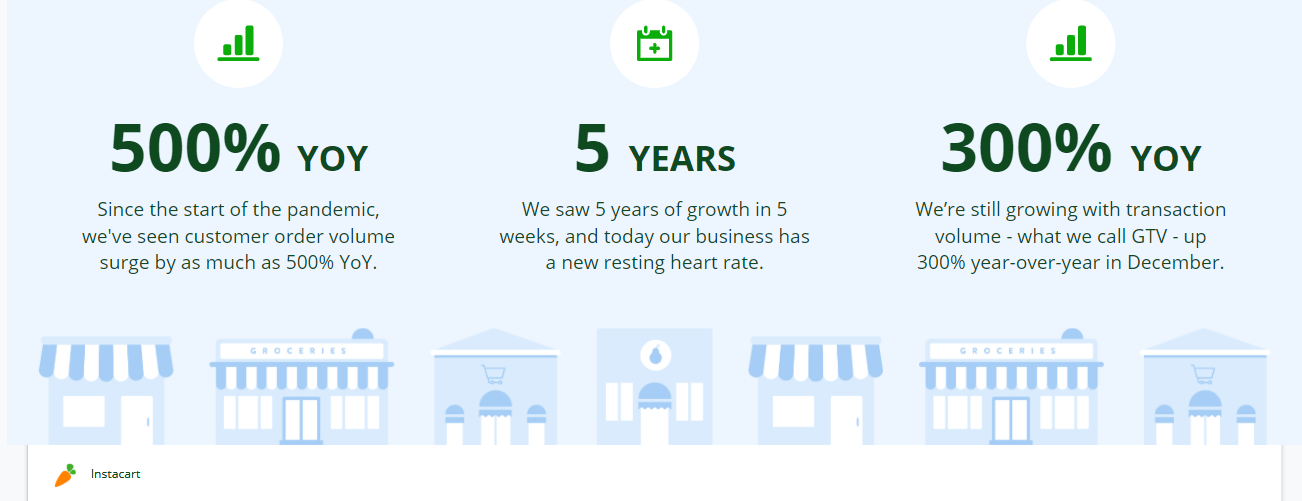

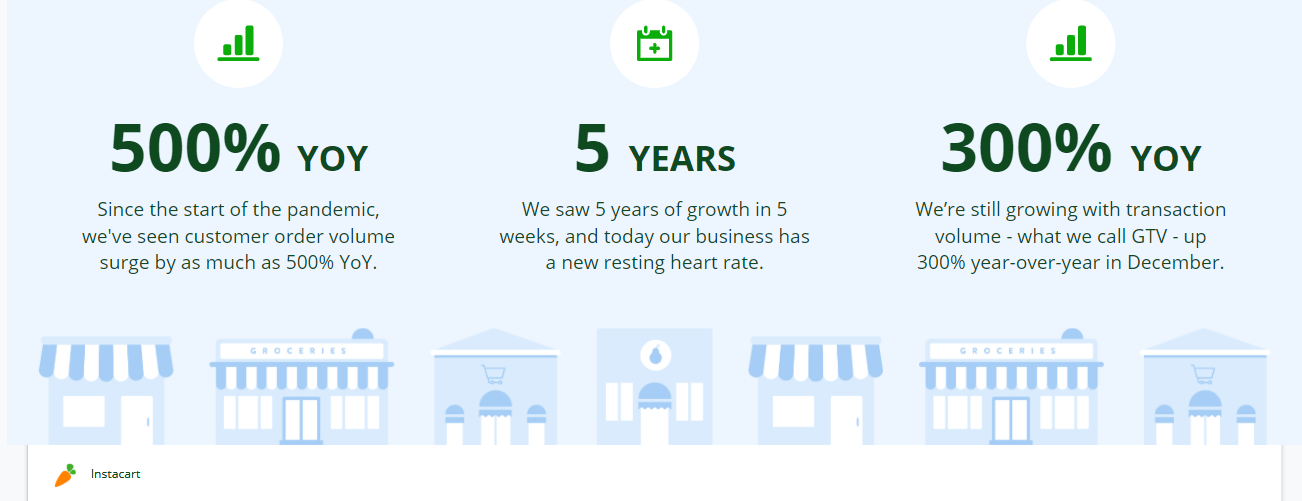

Instacart’s Incredible Growth

First off, let’s address the obvious issue of platform fatigue.

“Another platform?” you say.

To which the reply is unequivocal: “Yes, another platform.”

First, hear me out before you rush to judgment. There are some facts that you might not be aware of – most importantly, the sheer size and reach that Instacart has today.

Obviously, they’ve had quite a year. Because of the pandemic, grocery made light-speed strides in ecommerce enablement.

Growth initially forecasted to take up to five years ended up taking six months and Instacart’s advances weren’t just in the grocery vertical, either.

Beyond Groceries

Instacart saw five years of growth in five weeks.

Yes, weeks. Not years.

Today, the company partners with nearly 600 national, regional and local retailers, and added more than 200 of these partners in 2020.

With triple-digit YoY growth in transaction volume (GTV) in 2020 fueled by its reach across more than 5,500 cities and over 85% of U.S. households, you now have what I’m now calling “The Everything Offline Store.”

We’re talking about deep opportunities for CPGs with CVS, Walgreens, and Costco.

Unique specialty retailer relationships with Sephora, Bed Bath & Beyond, and Best Buy have expanded their category reach far beyond the already long aisles of fresh food and everyday essentials into a new level of convenience and with that, online shopping habits.

How Shoppers Use Instacart

Let’s walk through the way a shopper uses Instacart — specifically, the levels of selection they go through before even adding an item to the cart or performing a search.

A user will either open the app or go to the website (and that behavior alone is a whole shopping mood).

Users don’t really go to Instacart to casually browse; they have serious intent.

Upon arriving, they’ll enter their location so that Instacart shows retailers available in their area. The user then selects a retailer based before beginning to search or browse sales, categories, or coupons.

For marketers, all of those layers of qualification have been surmounted before they perform a search.

Your product can appear in row one, spot two; front and center, for “cereal” or “rice krispies” – head and competitor brand terms.

Here’s how you can get in on the action.

Getting Started With Instacart

Your product does need to physically be in stores. Sorry, I know I might just have gotten some DTC marketers’ hopes up there.

But in order to have something picked, packed, and delivered by an Instacart shopper, the product needs to live on a shelf somewhere at one of the more than 45,000 stores from which Instacart delivers.

Populating Products on Instacart

Some of the biggest FAQs about Instacart are:

- How do products get populated?

- How can that be changed?

- And, where is it?! (If it’s missing).

Content on Instacart comes from either the retailer or via third-party content service providers (CSPs) directly connected to Instacart.

If your product is in a physical store, and you want to become an Instacart Ads partner, you can regularly provide Instacart with product content that covers inventory, variation/assortment, title, description, and imagery.

Sorting that part out is the first place to start.

If you need to correct content on Instacart from the retailer, there is a JotForm you can request when working with an Instacart Account Executive on the advertising side of the business.

If you have a CSP, that’s a better pathway over the JotForm. It’ll be the most efficient and effective way to ensure the updates populate and persist.

If a product is missing on Instacart that is in a store/retailer, it’s likely the retailer hasn’t enabled that product to be listed and you’ll need to speak to your contact at the retailer (or possibly through your broker, if you have one).

As a search marketer, one of the thoughts that (hopefully) popped into your mind was: “I wonder if this is the same content already being sent to [insert name of search engine/marketplace here]?”

The answer is, it could very well be.

It’s definitely something to look into and may cause you to take action.

Distribution and Retailer Availability

In order to successfully advertise on Instacart, you do need to have a “decent” reach in terms of either the number of stores on the Instacart network and/or geographic reach.

For example, being in five stores may not generate enough volume if those stores are small or in less-populated areas.

But on the flip side, if one of those stores is at a popular retailer in a densely populated area like Los Angeles, this could be a viable channel for you.

Unfortunately, it’s the classic “it depends” answer as it relates to paid search. If your reach is in the hundreds of store locations and generally spread out across the US in major cities, then you’ll absolutely find that Instacart advertising will boost your bottom line.

Catalog Size

It helps to have a decent in-store assortment or at least variations in flavors or pack sizes for Instacart customers to choose from, especially if these are generally popular.

Trying to push clearance, discontinued, or harder-to-find variations will make it difficult to gain any traction in your advertising efforts.

A good rule of thumb is to have at least 5 SKUs before going much further.

Organic Sales on Instacart

One great way to tell if the Featured Product advertising is a good fit for you is to look at organic sales on the Instacart marketplace.

You won’t be able to break it down to a retailer level, but knowing what your assortment is across geography and retailers allows you to compare current organic sales to what your potential reach could be.

For example, if you are currently seeing a low percentage of category share (under 2%) or a small number of orders or sales for the last year but you are available in store locations in the thousands and have a double-digit (or more) variety of items available for sale – that usually means it’s a visibility issue and you would benefit from advertising.

This is especially true if you are seeing an increase in in-store sales at the individual retailer level then you are likely missing out on an entire audience that is going directly to Instacart and shopping from there.

Obviously, this is not an audience you want to miss.

Featured Products on Instacart

Now that we’re squared away on content, distribution, and catalog, let’s get to the fun part: advertising.

Through the self-service platform, any brand that meets the in-store criteria can sign up for a web-based account from which to manage campaigns.

Instacart’s Featured Products Fast Facts:

- CPC-based.

- Second-price bid auction.

- Exact match keywords only.

- Organized by campaigns and product groups.

- Bid on variants (flavors, sizes).

- 14-day click attribution, tied to the last clicked UPC.

- All UPCs have a history across the Instacart network, 24-48 hrs after campaign creation, organic search terms will auto-populate in the account, cutting down on initial test and learning time. Add those keywords directly to your ad groups!

- Each UPC has its own quality score. So the more popular variants will appear more often (for example a 16 oz instead of a 32 oz size).

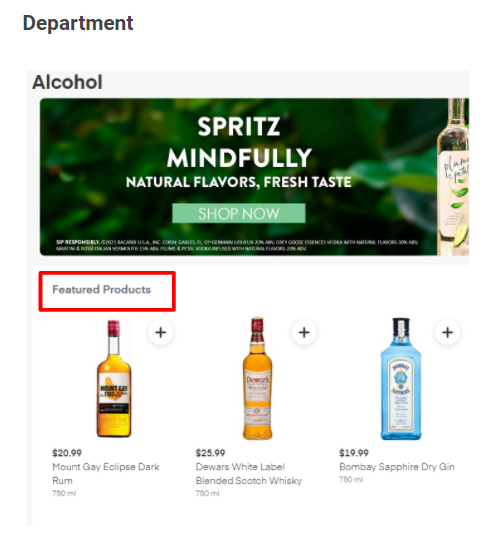

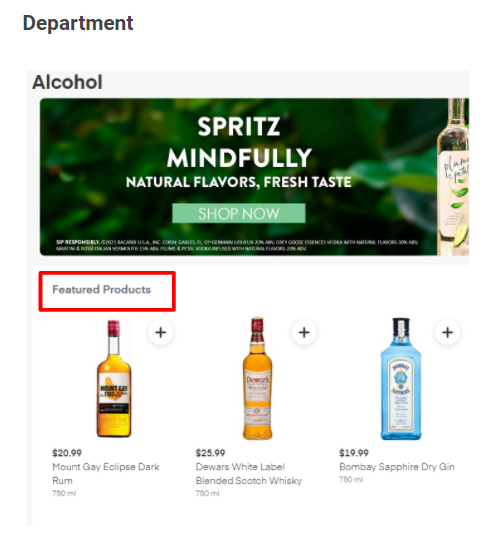

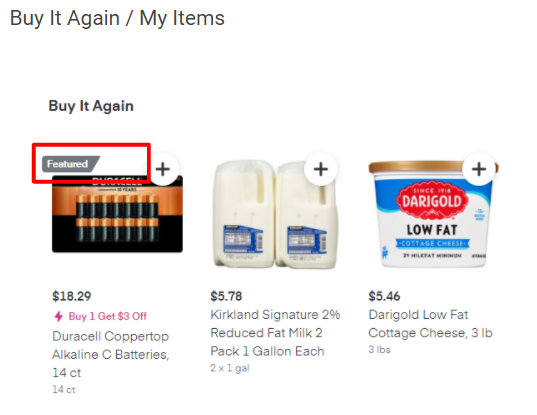

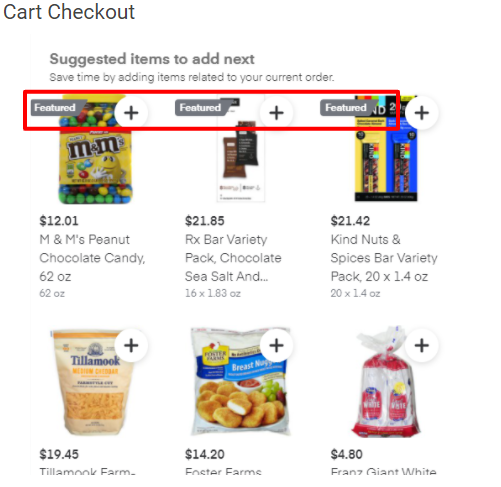

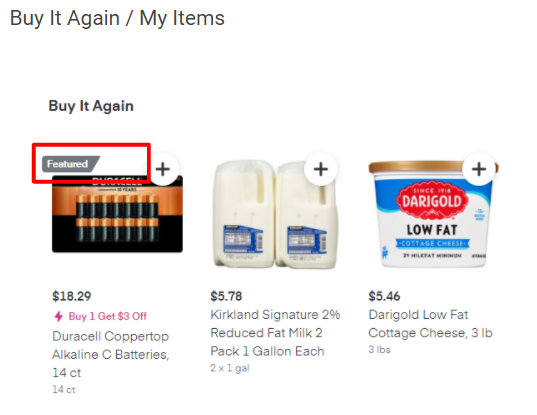

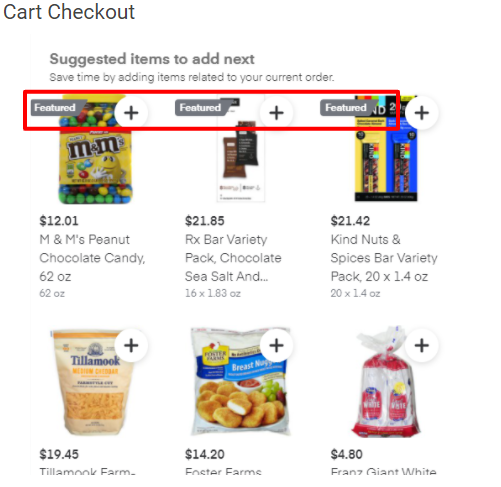

Where Featured Products Appear

Search (results, product detail pages)

Browse (homepage, department pages)

Personalized (Buy It Again, Cart Checkout pages)

Optimizing Featured Products

A more granular structure is the best approach for most categories, especially CPG/grocery-type items.

The volume is so much (and fast) that you’ll reach budget caps and ad group bid minimum ceilings quickly.

So you want to organize and build for scale. Each ad group has a recommended minimum bid that qualifies you for the browse and personalization placements.

You’ll want to be competitive and not smash a bunch of kinda/sorta-related products or keywords into a single ad group.

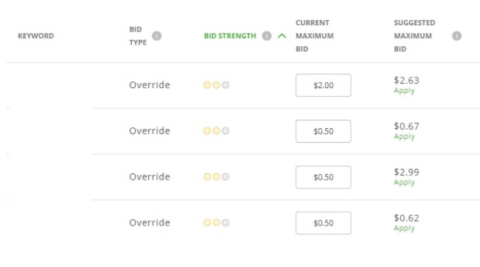

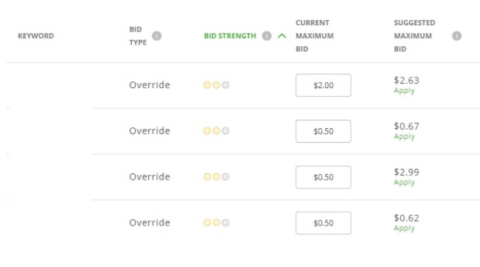

You’ll also receive a bid strength metric at the keyword level for the search placements on SERPs and product detail pages. So you can decide for specific keywords how competitive you want to be.

The strength levels are pretty straightforward, green for strong, yellow for weak, and red for not showing.

A more granular structure will allow you to make bid adjustments at the ad group level so you don’t have to constantly adjust bids at the keyword level.

Keywords will use the ad group bid unless an override bid is applied: either higher or lower, so save yourself management time and use that override on keywords that are of more importance for tracking.

Here’s a fun stealthy tactic: Bid on competitor brand names or keywords.

Be sure to put those in a separate ad group though, so you can control which competitors you want to be more aggressive on without eating up the budget with other terms that aren’t competitor-related.

You should not create a separate campaign. When you create a campaign, you select not only keywords but what products those keywords apply to at the campaign level.

Once those products are in a campaign, they cannot be added to another.

This way, you’ll also avoid competing against yourself.

Budgeting for Featured Products in Instacart

There are two options available today: Paced Spending and Max Impressions.

Both depend on the end date of your campaign and the total budget that you input and the system then spends based on those instructions.

For Max Impressions, the system will show your items as often as possible until the budget is exhausted.

This may work well for less-trafficked items, like specialty goods or those in a category that is newer to Instacart, like consumer electronics.

Paced Spending takes the end date of the campaign and the total budget and divides that out across that length of time in order to consistently serve and spend each day.

You may run out of budget earlier in the day as a result (sorry, no dayparting in the UI yet) and miss out on peak shopping times in the afternoon.

You’ll get a daily emailed report (if you opt-in) from Instacart with the number of missed impressions due to the budget capping out early to help you determine what budget profile is right for you.

When a campaign end date is reached, you do not have to create a new campaign and start over. You can re-up your current campaigns with new budget amounts and keep on trucking.

You can also switch between the budget types in an ongoing campaign, so you can test both.

Now What?

If you’ve read this far, you’re probably pretty warm to the idea of the Instacart Ads offering.

If you’d like to read more in-depth articles or need more resources, check out the Help Center in the advertising platform, as well as the Instacart Advertising blog, which is hosted on Medium.

And you can always reach out and ask me questions!

More Resources:

- How to Create a Paid Search Plan That Will Drive Results

- How to Create Paid Search Offers That Are Actually Profitable

- The Biggest PPC Trends of 2021, According to 32 Experts

Image Credits

All screenshots taken by author, March 2021

Sorry, the comment form is closed at this time.