19 Aug What Search Marketers Should Know About Amazon DSP via @ebkendo

Amazon’s Demand Side Platform (DSP) might not be the initial platform you think of when putting together a channel mix that includes Display options.

You first think of the Google Display Network (GDN) – maybe the Trade Desk, Criteo or any number of exchanges – probably assuming that you have to be a seller on Amazon to take advantage of DSP.

Nope.

In fact, it’s a great way to take advantage of the network of owned by Amazon sites (like IMDB, and partner exchanges they connect to) the same way that Google does.

And yes, these are placements that you are driving back to your website, not Amazon.

Plus, you get to take advantage of Amazon’s in-depth knowledge of consumer behaviors on their network and on their platform, like:

- Purchase history.

- Brand affinity.

- Searches performed.

184 million U.S. monthly visitors is a bit of a perk as well.

Let’s break it down, starting with the option most attractive to a search marketer who’s doing display and going through some options that are more awareness media buy based to the classic demand capture, retargeting.

What You’ll Need

First off, you’ll need a DSP account, which is separate than an Amazon Ad Console account that you would have for running Amazon Advertising options like Sponsored Products, Sponsored Brands and Product Display Ads.

Just as in GDN and any programmatic campaign, you’ll also need assets, like banners, interstitial and short videos, created to Amazon’s specifications – depending on what you want to do.

There is no automated creator or templates like there is with the Google Display Builder.

But similar to Google, it can take a while for impressions to build and performance data to come in, so you’ll want to plan a similar length flight date and come armed with enough asset inventory.

Where the Ads Show

Besides the obvious sites like IMDB, Audible, and whatever else Amazon bought this week, there is a list of exchanges you can check out here.

This list also includes third-party partners that you can leverage to upload your first-party data, like email unsubscribes. (Don’t let them get away that easy!)

Note: For those of you familiar with the space, you might see a couple of exchanges that you recognize.

There is the potential for overlap if you were running ads on both platforms simultaneously, and possibly even show two ad units on the same space. For example, The Trade Desk does have inventory for Amazon Fire TV.

Example of a dynamic CTA Amazon DSP unit

Example of a dynamic CTA Amazon DSP unitSome more specific notes on creative – not only do you need to provide the assets, but you’ll need to pay attention to:

- Calls to action.

- The use of text in the creative.

It’s because there’s a dynamic ads unit where the call to action is overlaid by Amazon.

You do not get a choice of what the CTA is and you do not get stats as to which CTA was used, when or detailed performance, just the overall performance of the creative size and version.

So be really really sure that if you’re re-using assets from Google or Facebook that you adapt them appropriately.

The unit that I recommend most to start with from a search marketer’s perspective is the dynamic ad unit targeting in-market audiences.

It’s most similar to the dynamic options on Google, you’re taking advantage of Amazon’s knowledge of response/CTAs on a per-user basis. While it’s technically a middle of the funnel tactic, it has a better chance of landing in that purchase bucket.

An in-market audience will target those that have searched for or bought products recently (last 30 days) in your category and can get pretty specific via Amazon’s network.

I saw a segment for Tom Hanks Fans, which really now that I think about it, aren’t we all? Perhaps go with the lesser popular, yet equally nice guy segment of Paul Rudd?

For a real example though, if you had a new line of kitchen gadgets that you wanted to launch (spatulas and whisks for all!), you could then target in-market audiences for mixers, toaster ovens or kitchen gadgets.

While starting broader (kitchen gadgets) and narrowing is the best way to go, I get that the search marketer in you may not like “paying” for those learnings and want to be more specific at the start.

So, layering on certain household incomes and age ranges or blocking certain sites/exchanges before launching would be the best way to that without having to lower your bids too much.

Still, depending on your budget and desired reach, you’d want to start with a wider net like just audiences in Google. Then, layer on demographic targeting (or category exclusions) then narrow the targeting to increase the efficiency.

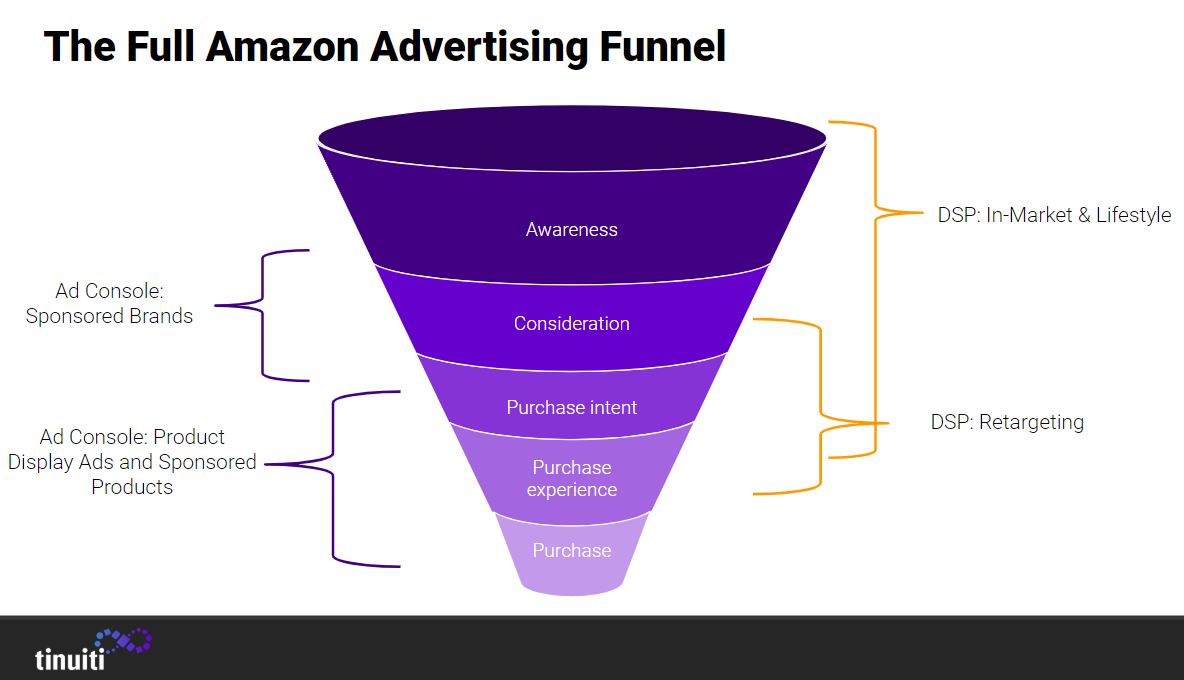

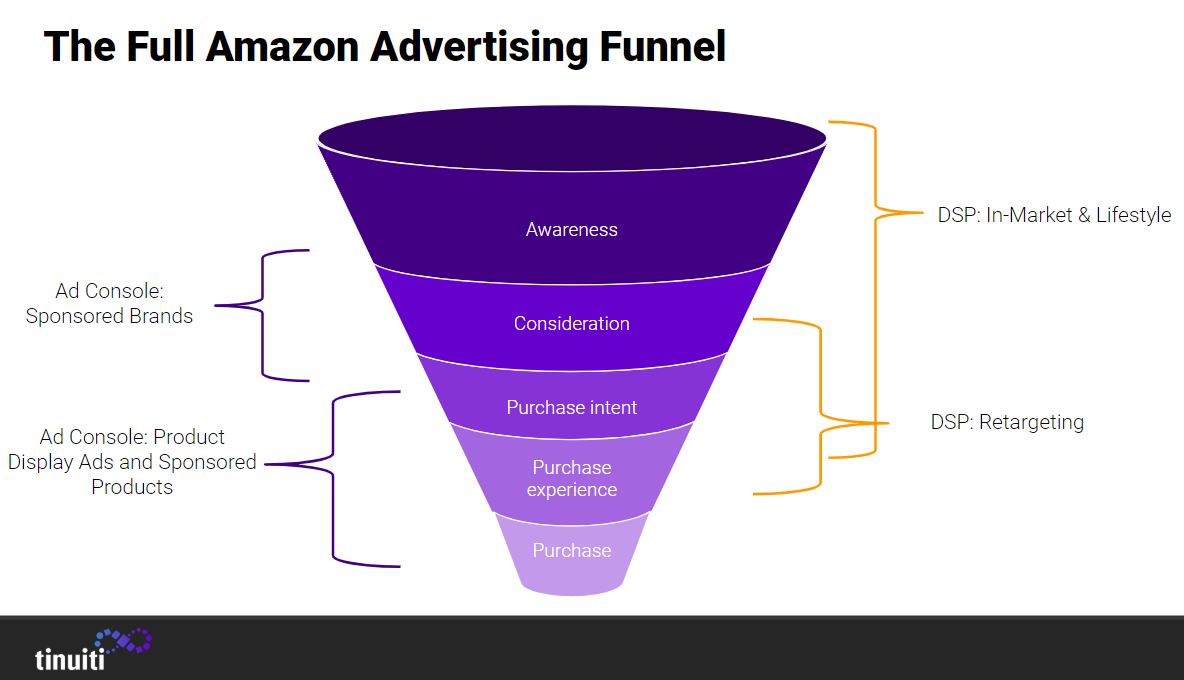

Here’s a look at where DSP sits versus other Amazon Advertising offerings in the purchase funnel.

Cost & How Long It Takes

Cost is CPM-based. It can take a little time for campaigns to gather enough impressions and for data to be smart enough to get the targeting right and ramp up.

Amazon recommends an “always on” methodology (again, sound familiar?), which makes sense for continuous advertisers that have plans for retargeting.

The platform gets more efficient over time and you will be able to build better lookalike audiences to add as a segment later. (Remember, Amazon has a lot of purchase data!)

Real answer: you want to set up and run for at least 3-6 weeks before making any major adjustments, depending on how much volume you’re seeing.

As far as the average CPM, expect to see $4-$6 depending on the category and that larger catalogs (thousands of products) need larger budgets.

Most in-market segments sit around 500 million available impressions per month, again, depending on the segments.

Recommended budget to kick this off is about $5,000/month, especially if you want to do retargeting, for a smaller catalog (tens of products).

Ideally, closer to $10,000/month to be able to have the flexibility to really run with it, as the targeting options, just like other programmatic exchanges, can be fairly limitless.

Take It a Step Further: Retargeting

There is a retargeting option, but it requires the installation of the Amazon pixel on key pages (ideally checkout page, home page, and receipt page) in order to build audiences.

But recognizing that some ecommerce sites choose not to also sell on Amazon, they may not be comfortable with giving Amazon that information, so this is a no-go option.

However, if you’re advertising and the main reason you aren’t selling on Amazon has more to do with the logistical difficulties in meeting fulfillment, inventory, reviews, and pricing requirements, then this is a great solution to tap into that 148 million monthly users from a platform that supposedly has 48% of all ecommerce transactions.

(The options, strategy, and needs are another article in itself and I have a schedule to keep, so look for that later this year. I’m just trying to get you to finish skimming this one today.)

Getting the Word Out: Connected TV & Lifestyle Audiences

For those out for a pure awareness/branding play, consider Amazon’s OTT (over the top) unskippable video on Fire TV and Fire Stick. These units can be 15, 20 and 30 seconds long.

Over 7 billion hours were streamed through the platform in Q4 of 2018 (per Amazon Advertising) and as we all know, so many of us watch TV (linear or connected) with another device in hand – about 45% of adults in the U.S. admit to doing this.

This medium though does require offline measurement capabilities or modeling, if you want to know the full effects of the effort.

You can also opt to go really simple and run this campaign only on Amazon and see if there is any lift in other channels during the flight. (Not the most scientific way, but I heard the Earth is flat now, so anything’s possible it seems.)

There is another option in that awareness bucket, lifestyle audiences, where you can target users based on broader interests like “foodies” and “sci-fi fans”.

This option adheres to the same creative specs and CPM charges as In-market, but is definitely more of a programmatic style media buy in terms of metrics to watch, return and measurement.

I would recommend this ad unit next after In-market for those wanting to start with a larger test run.

Ideally, you’d run both In-market and Lifestyle segments concurrently, fill up a retargeting pool, start that, rinse and repeat with more products as you’re able to build out creative assets.

To Sum Up

Inventory is changing with who and where and needs are shifting.

Amazon Advertising continues to be a new source of possibility and one that has lots of room to run and lots of data to leverage.

I barely got into the real meat of the offerings here, I recommend checking out the Amazon Advertising site and a good old-fashioned Google search for DSP content and recommendations.

More Resources:

- Amazon Advertising Options Guide: What Marketers Need to Know

- Amazon Advertising: The 2019 Guide

- Amazon PPC Challenges Google Ads

Image Credits

All screenshots taken by author, August 2019

Sorry, the comment form is closed at this time.