15 Apr YouTube’s Struggle: Soaring Views, Declining Revenue via @SusanEDub

The latter half of March held a bullish outlook for YouTube: users would be home more, increasing screen time.

This meant more demand, which in turn, would mean more content and more ad spots.

There was some trepidation around what ad spend would look like in the Coronavirus reality, but there was optimism surrounding the ability for YouTube creators to gain audiences and capitalize on ad revenue.

The COVID-19 Content Evolution

Something that was still evolving at that point was Coronavirus coverage. Platforms have switched their stances several times in the past weeks as the situation has evolved.

Originally, YouTube had a policy of no monetization around COVID-19 content.

This was changed to only disapproving videos that violate policy or spread misinformation.

However, as that content ramps up in volume, publishers aren’t seeing corresponding revenue come with it.

The Association Issue

YouTube publishers are feeling something that has become a larger ripple effect across display and programmatic mediums:

Advertisers don’t want their ads to appear with Coronavirus content.

When running display ads, advertisers have the ability to opt out of site types, such as news. They can also supply a list of content and keywords they want their ads to stay away from.

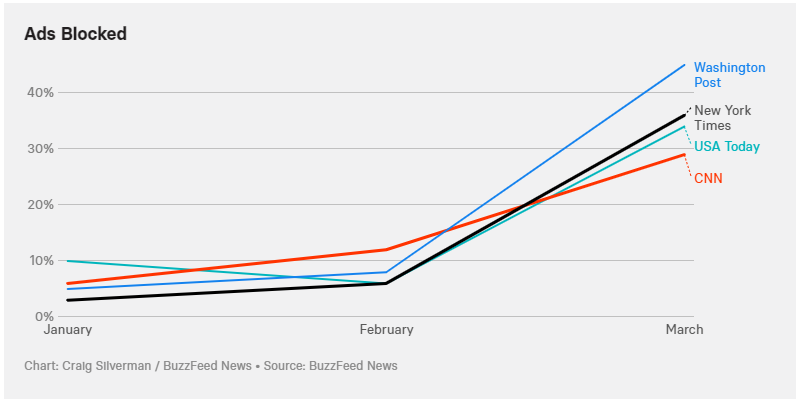

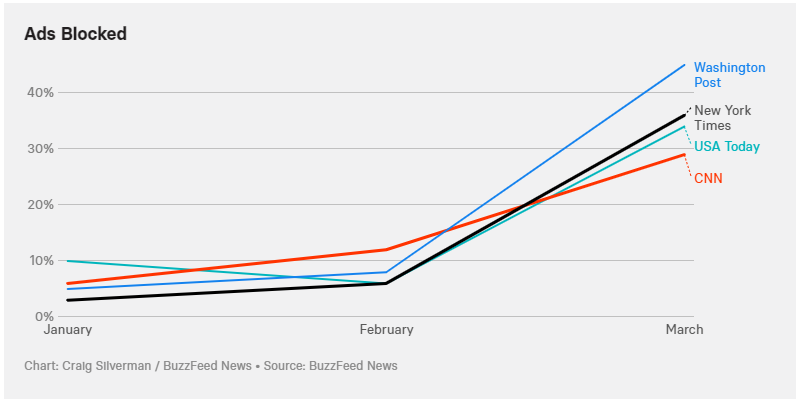

This is translating to millions in blocked ads, with one ad verification company noting there was a 36% blockage of ads for the New York Times in March. This is a marked difference from the 3-6% ranges at the start of Q1.

Is Advertiser Fear Justified?

Some data is showing advertisers are overcorrecting for this perceived reputation issue.

According to a March study by Integral Ad Science, only 16% of respondents said they’d have a less favorable attitude towards a brand if they saw their ads in conjunction with Coronavirus content.

In almost half the cases, those surveyed said they’d actually want to see ads by certain types of companies alongside that content, including pharmaceuticals and health-oriented brands.

One-Two Punch to Earnings

This same effect is what’s currently impacting the revenues experienced by YouTube publishers.

It’s the dichotomy of very high content supply, but low demand for advertising placement.

“We’re seeing record engagement but that’s not correlating to ad dollars coming in.” – Anonymous Digiday Source

Publishers would normally enjoy this engagement-rich environment, but the weakened ad spend from brands combined with their skittishness about appearing alongside Coronavirus coverage is created a compounded problem.

According to Tubular Labs data reported by eMarketer, since March 11, 30% of the videos uploaded to YouTube by news outlets were about COVID-19.

Those videos alone created 40% of the views the publishers experienced.

Contrast that with information Digiday received that Coronavirus stories bring in 30% less revenue than non-Coronavirus items.

Combine that with slashed ad budgets, and it creates a multi-faceted issue for publishers. Two anonymous sources who spoke to Digiday reported CPMs rates that had fallen 20+%.

“We’re creating inventory faster than they can fill it.” – Digiday Anonymous Source

Continuing to Create Opportunity

As the social distancing mandate wears on, some opinion is that this fear around brand association with COVID-19 will decrease. The “new normal” will mean that appearing alongside Coronavirus coverage will be seen as normal itself.

YouTube has continued to forge ahead with supplying tools to help small businesses in their content creation.

Just this week they launched the beta of their YouTube Video Builder to give a leg up to small businesses who may not have video production capabilities.

Search Engine Journal also has a piece today specifically on the types of content flourishing in this new landscape.

Image courtesy of Digiday

Sorry, the comment form is closed at this time.